The most important factors driving investment returns over the next 10 years: [Regulation & Vortexes] (and how to profit from them)

There are two.

First is the power dynamic between corporations and government. In the United States corporations are more powerful than government. When new laws are written it is the biggest corporations who decide what they should be and then the government puts them in place. Case in point - what is happening right now with AI regulation. Tech Giants and their CEOs are being invited to congress to suggest what regulations make the most sense. Rest assured they will recommend whatever most entrenches their power. These companies are - thankfully - NOT public benefit corporations. Their primary interest is putting profits into the pockets of their shareholders - and this is a wonderful thing for investment returns.

Healthcare is another prime example of companies drafting their own regulations.

I want to clarify - I despise the healthcare system generally and Big Pharma in particular, and in my perfect world there would be no regulation at all. Alas, there will always be regulation, and I believe that from the perspective of shareholder returns - it is a far better thing to have companies draft regulations than governments.

This power balance where companies > government is ONLY the case in the United States. In every other country on Earth this dynamic is reversed.

Companies domiciled in the US already have enormous competitive advantages versus companies domiciled elsewhere, including: looser labor laws, deeper capital markets, vast natural resources, the US dollar, entrepreneurial DNA, leading universities, local market size (the list goes on). But the regulatory dynamic might end up being as impactful as any other advantage over the coming decade. As the pace of technological progress accelerates the likelihood of governments getting spooked and over/mis-regulating skyrockets (see Europe and China already doing this to their own detriment). Worse still, companies’ ability to survive and thrive in the future will be largely tied to their ability to implement all of the wondrous new technologies that come along - most of which will have the core function of replacing labor. Tight labor laws will be one of Europe’s primary Achilles’ heals. China’s will likely be their misunderstanding of how detrimental it is to try and steer investment.

The chart below shows the performance of (in order) US tech stocks, the S&P 500, the all-world ex-US index, emerging markets and Chinese large-caps.

US companies may not outperform by a similar margin - certainly some form of reversion to the mean is possible (likely, even). But there is no doubt that they will outperform any of the above baskets over the next decade.

I don’t think much more needs to be said about the first factor, so the rest of this post will be about the second factor - the continued (and accelerating) proliferation of what I will call the Vortexes.

Vortexes are companies that hoover up ever increasing quantities of economic value that was previously captured by a much broader variety of companies.

As always, I’ll explain what I mean using an anecdote. Consider the case of a clothing brand in the 1960s…

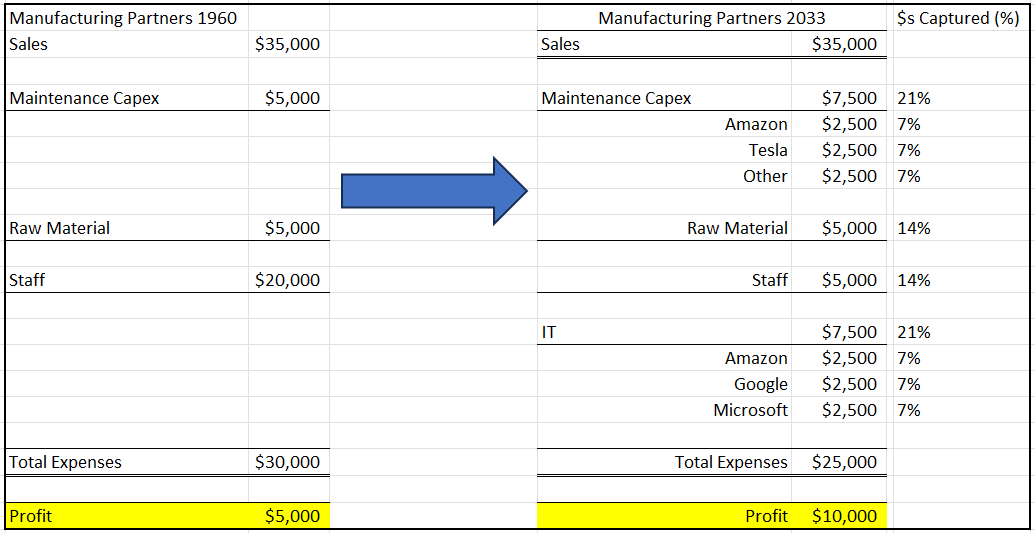

A simplified P&L might look like the following.

One way to look at the P&L is to consider every $ being paid out as a $ of value being captured by some party. Newspapers are capturing 5%, the company’s manufacturing partners are capturing 35%, the company’s general and administrative employees are capturing 25% - and so on…

We can further breakdown the value capture in the following way:

In practice there would be many different companies under the Newspapers, TV/Radio channels, and Stores - each of which would support their own network of suppliers and service providers.

Similarly, manufacturing partners might include a broad variety of companies depending on the type of clothing being manufactured - who support their own networks of suppliers depending on the type of fabric being used and the type of machinery required.

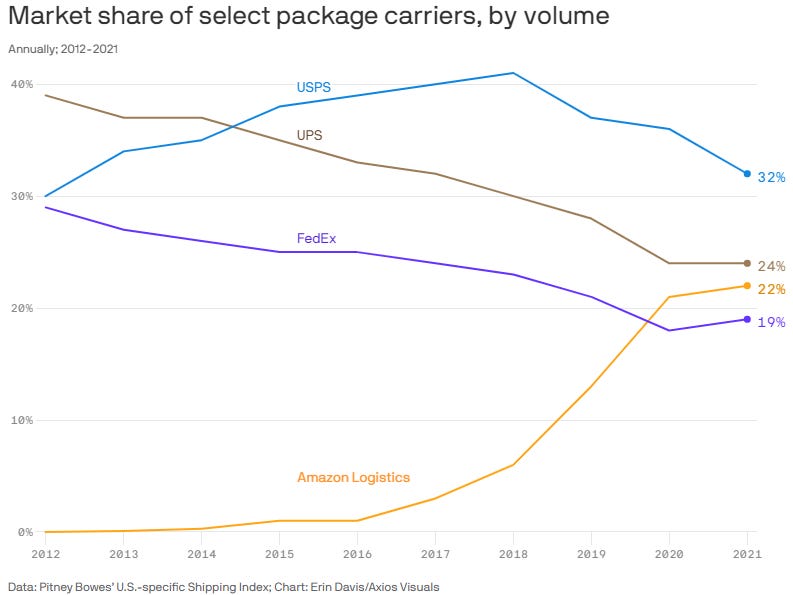

Distribution would be provided by a vast network of physical retailers, and logistics would be handled by providers of warehouse space, UPS, Fedex, the US Postal service, LTL carriers - and so on.

Now consider the same hypothetical except it’s a clothing brand in the year 2033.

Rather than having the advertising dollars distributed across a vast number of companies in the newspaper, TV and radio markets - they are instead distributed across only three companies - Amazon, Google and Meta. Rather than paying a huge variety of suppliers the tech giants are mostly spending their money on compute and employees.

For the sake of brevity let’s consolidate the manufacturing partners and look at their own hypothetical P&L in 2033 and compare it to 1960:

Profit has doubled primarily because staff costs have plunged.

Maintenance capex now mostly takes the form of paying fees to Amazon and Tesla for the robotic automatons that now run the production facility and warehouses.

Staff costs have been replaced with subscriptions to companies like Microsoft, Adobe OpenAI, and cloud-expenses -which have together automated most of the white-collar jobs.

Similarly, the G&A category from our Clothing Brand has dropped from $25,000 to $15,000 as software has replaced a huge portion of their internal white-collar jobs (design, copywriting, etc).

Again, the prime beneficiaries of lower G&A spend are the tech giants providing said software.

Even Distribution expenses flow back to the tech giants.

The stores component of distribution has been replaced by digital advertising and the cloud costs of hosting and running a web-presence.

The logistics component of distribution goes into the pockets of Amazon (via their fulfillment network) and Tesla - who provides the level 5 driverless vehicles on which Amazon’s delivery fleet runs.

I couldn’t find an updated chart but I have read that Amazon surpassed UPS in delivery volume in 2022:

Let’s revisit our definition of a Vortex: companies that hoover up ever increasing quantities of economic value that was previously captured by a much broader variety of companies.

These companies are owners of the platform technologies that underpin everything. Crucially - because they are capturing economic value from so many different sources they don’t face the same economic limitations as non-Vortex businesses.

Retailers must make money selling products.

Amazon can run retail at zero margin and make money serving ads.

Warner Brothers and HBO must make money by monetizing their content.

Meta and Youtube don’t need to spend money on content to drive eyeballs because their users create it for them. Similarly, Apple and Amazon can run their content operations at a loss because they profit elsewhere.

Microsoft doesn’t need to spend nearly as much money on advertising as other software businesses because every company on Earth is already their customer.

Over the coming decade an ever larger piece of the economic pie will be captured by the Vortexes.

There will surely be new Vortexes outside of the tech giants - but what will hold true is that an ever larger share of economic value will flow into the hands of an ever smaller number of companies. This is what happens when technologies become generally applicable. The net result is that US-based companies will grow ever larger as a share of global GDP, TAMs and market caps will surprise to the upside, and winners will win more than ever.

Expect the allocations of US based indices to continue concentrating…

Cloud computing is applicable to literally every business on Earth. Machine vision will become applicable to every manufacturer and warehouser (and will be powered in large part by the cloud).

Large language models (LLMs) will replace the humans currently in customer service and tech support roles. LLM $ will flow into the Vortexes of:

Cloud providers powering the LLMs (Microsoft, Amazon, Google)

Providers of the LLMs themselves (OpenAI/Microsoft, Meta? Amazon? Apple?)

Tools that automate creative work will increase the value of top creatives by 10X while dropping the value of the bottom half of creatives to zero. These funds will flow into the Vortexes of:

Cloud providers (yes, this will be a theme)

Providers of creative automation: Adobe, Epic Games (via Unreal Engine), Apple

Generative AI tools like ChatGPT, Midjourney, StableDiffusion, and coming to the world in December Google’s Gemini

Maybe one of the biggest transformations will come from the automation of blue-collar labor. These funds will flow into the Vortexes of:

Cloud providers

Tesla/others who come to dominate the space that will encompass machines who have learned to interact with the world - thereby enabling fully driverless cars and humanoid robots

Healthcare will also be transformed. Still to this day the majority of R&D in the biotech space is done through what essentially amounts to complicated A/B testing. Once we figure out how to fully digitize the information contained in the human body this will change. Dollars will flow - again - into the Vortexes that dominate AI and cloud computing (Deep Mind within Google for example?). We may even find that intelligent robots become the primary providers of care, and the diagnosticians of diseases (both are already happening: robots providing care/companionship in Japan, and GPT 4 and many other tools being used to diagnose diseases everywhere).

And of course we cannot forget one of the most important Vortexes of all - semiconductors. Literally every single Vortex is built on top of the Semiconductor Vortex. All. Of. Them.

Here are the final takeaways:

Big Tech will continue dominating

US Companies will outperform non-US companies

Companies who dominate in the future will be those who become Vortexes or those who - for some reason - are not susceptible to Vortex disruption

Closing thought

These principles guide my ideas around how to re-constitute indexes.

Indexes are beautiful things. An S&P 500 index will beat 90% of active managers over 15-20 years and 70-80% over 10. The Nasdaq 100 will probably beat even more.

That said, I do believe indexes can be beaten by following some very simple thought processes to their logical conclusions (I’ve written two posts explaining this in detail HERE and HERE).

In a nutshell - it is far easier to identify companies which have ZERO chance of ever obtaining Vortex dynamics, and companies that are obviously susceptible to disruption by Vortex dynamics - than it is to pick out which companies will actually create the biggest Vortexes. So, rather than trying to pick stocks - start with the components of an index and remove the trash that’s susceptible to disruption (or which is being attacked by some obvious secular headwind, shitty management or regulatory impediment). Then re-allocate those funds amongst the remaining constituents.

We can eliminate the following sectors entirely:

Utilities: just shitty businesses

Energy: secular headwinds, shitty businesses because of exposure to volatile commodity prices - no chance at becoming Vortexes (outside of Tesla via their burgeoning battery business [see: megapack])

Retail: getting wrecked by Amazon and ecommerce generally - impossible to perpetually differentiate in-person experiences due to finicky customers - awful cost structures - THE definition of companies getting disrupted by Vortexes

Healthcare (healthcare companies of the future very well might create Vortex dynamics, but few if any of the companies in the S&P 500 have that chance and you’ll be better off removing them because the allocation to potential winners will be so small that it won’t make up for the lagging performance of the rest of the sector)

Financials: shitty businesses that are either regulated for being too big to fail or susceptible to economic shenanigans outside their control. Also usually run by morons (see Wells Fargo and Goldman Sachs - both run by absolute buffoons whose stupidity is only outmatched by that of their shareholders). ZERO chance at becoming Vortexes.

These sectors don’t have a prayer of matching the returns of the remaining index constituents over the next 10 years (as baskets).

Note - this is a VERY different thing from saying they will not have any periods of outperformance - they surely will - values could drop to the point at which forward returns become very attractive over a period of time (see energy stocks during peak inflation), but I like to construct portfolios and let them be for the long term, and over the long term earnings growth is the primary driver of returns.

I’m probably going to write a new post that will essentially be an update of my post titled: “How to beat the S&P 500”. In it I would update/outline the thought process behind which companies to remove (including many that aren’t in the sectors listed above who are susceptible to Vortex disruption), and also opine on some position size limits - which can become an issue if you are re-allocating a huge swath of the index weightings back into the remaining constituents.

Warm Regards to you all,

-Ben

great coverage, thank you!