The QQQ is an ETF that tracks the Nasdaq 100 index - a market capitalization weighted index of the 100 biggest companies that trade on the Nasdaq exchange. The chart below shows the performance of the QQQ vs. the SPY (S&P 500 Index) and the VTI (Vanguard Total Stock Market Index) since 2003:

The performance is truly something to behold. In this post I will explore two things:

Why the QQQ beats every other broad index on Earth and why it will continue to do so

How to create a new index using the QQQ as a baseline - that has a good chance of beating the QQQ (and that will certainly beat the S&P500)

Lest you think I was cherry picking a timeframe that was advantageous to my point, below are a variety of charts from different periods, and at the end I show rolling 5 year returns starting in 2003.

Returns since the top in 2007

Returns since 2013

Returns since 2018

Returns since Covid

The outperformance is incredibly consistent. The below figures are 5 year outperformance compared to the S&P 500.

2003 – 2007: +30%

2004 – 2008: -6%

2005 - 2010: + 14%

2006 - 2011: + 25%

2007 - 2012: + 35%

2008 - 2013: + 23%

2009 - 2014: + 76%

2010 - 2015: + 34%

2011 - 2016: + 36%

2012 - 2017: + 28%

2013 - 2018: + 44%

2014 - 2019: + 35%

2015 - 2020: + 33%

2016 - 2021: + 95%

2017 - 2022: + 117%

Since March 2017 (5 years ago): + 62%

I’ll state the obvious, there is a takeaway here: Buy the QQQ over any other index. For those of you who are more adventurous and can take more volatility, the SMH and the IGV (Software index) are the only two indexes that reliably compete with the QQQs. I haven’t done any research on the software index, but I am quite bullish on the SMH for the next ten years. I explain the bull thesis for semiconductors in a different post linked here.

Same exercise as above but this time comparing the SMH to the QQQ (I eyeballed the below data using a chart so it may be off a bit, but the points hold).

2003 – 2008: -55%

2004 – 2009: -37%

2005 - 2010: - 23%

2006 - 2011: - 38%

2007 - 2012: - 25%

2008 - 2013: - 12%

2009 - 2014: - 30%

2010 - 2015: - 12%

2011 - 2016: - 25%

2012 - 2017: + 30%

2013 - 2018: + 53%

2014 - 2019: + 30%

2015 - 2020: + 70%

2016 - 2021: + 140%

2017 - 2022: + 110%

Since March 2017 (5 years ago): + 60%

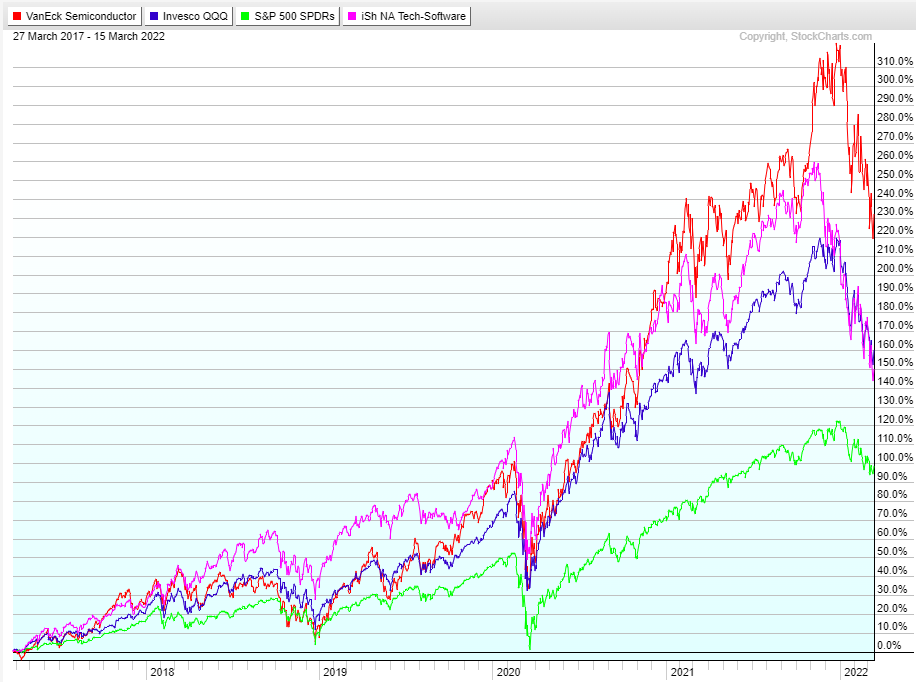

This chart shows past five year returns of SMH, QQQ, SPY and the IGV software index.

If you’re wondering what changed that made the SMH go from severely underperforming to massively outperforming, there are two main answers:

Smartphones

Cloud

Smart phone sales per year since 2007

Cloud computing market growth since 2008

Smart-phone unit sales are now less relevant to semiconductor growth than is the data-creation that smart-phones and their ecosystems spawn (which shows up in the cloud growth category). Even though smartphone sales have stopped growing, the demand for semiconductors will keep accelerating due to electric vehicles, the internet of things (IoT) market, continued growth in hyperscalers/cloud, and the proliferation of 5G (a ten year + trend that hasn’t really even started yet - deep dive linked here).

In order to understand why the QQQ beats the SPY, it’s important to first understand why market capitalization weighted indexes work so well in the first place.

Market cap weighted indexes are inherently trend-following portfolios that let their winners run and cut their losers. They don’t actually cut the losers - but they let the losers cut themselves by underperforming.

They are guaranteed to hold the next Apple, Amazon, Google, etc - for the MAJORITY of their bull runs. Apple’s market cap in 2003 was less than $10 billion, Amazon’s was around $15 billion. So, the subsequent $2.6 trillion and $1.5 trillion in gains respectively were all captured by the index - 99% of the moves!

They are essentially portfolios that allocate the most money to the strongest companies.

I made the following slide for a presentation I gave years ago that speaks to some other benefits / history of indexes.

Market cap weighted indexes are even more powerful today due to the proliferation of technology-based winner-take-all business models - another trend that is likely to hold true for the next 10+ years at least. Consider further that today one of the most valuable competitive advantages is network effects (see literally any of the tech giants). Remember when companies were hitting $1 trillion market caps and everyone thought that they had gotten so big there just wasn’t room to grow anymore? The new competitive landscape will allow companies to grow larger than anyone (even today) thinks possible. The odds are very good that we’re only 10 years away from seeing our first $10 trillion market cap. Whichever company reaches that incredible milestone will inevitably be a very large component of a market cap weighted index.

Not all market cap weighted indices are equal. There are two primary reasons the QQQ beats the SPY:

It is more concentrated, allowing more room for the best performing businesses to contribute returns

On a relative basis, SPY includes far more dog-shit that is guaranteed to underperform over time (e.g. 3M, AT&T, Wells Fargo, Airlines, I can go on…)

To be fair, the SPY is less volatile because it is more diversified. Its outperformance year to date is because it does include things like energy producers (also dog shit in my view) - but there is no doubt that these inferior businesses will underperform the QQQs over a long period of time.

Let me stress before continuing. The exercise here is to create a product that will beat the performance of the QQQ over a long period of time (at least 5 years) on an absolute basis - not on some form of risk adjusted basis. The changes I’m going to propose will almost certainly increase volatility.

I want to make one more qualitative point about the SPY and the QQQ. Another way to look at the two indexes is to consider the concentration of talent. The QQQ allocates (by its concentration) far more to businesses that employ the world’s brightest and most motivated minds. General Motors, Bank of America and 3M have no prayer of competing for talent against Google, Microsoft and Apple. So, not only does the QQQ have a higher concentration of businesses with vastly superior economics, it also has a vastly higher concentration of superior brains taking advantage of those economics.

To put it another way, we have Tom Cruise’s Maverick from Top Gun (top talent) flying an F-35 (working for Microsoft) in a dog-fight against Chris Farley’s Tommy Boy (bottom talent) flying a blimp (working for General Motors). Yes, I know these companies are not competitors - but all companies compete for talent, and all companies in an index fund are competing for returns on your invested dollars.

Now for the holy grail - how to beat the QQQs.

Step 1: Remove the Shit

We don’t want to risk being tricky here. It is far more dangerous to our long term results to remove a business that goes on to perform well - than it is to leave in a business that ends up performing poorly. Our default will thus be to leave a business in the index unless we have a very high degree of confidence that it is likely to underperform long term.

The QQQ includes the following sectors:

Information Technology (50.42% weighting)

Communication Services (17.52% weighting)

Consumer Discretionary (15.89% weighting)

Healthcare (5.97% weighting)

Consumer Staples (5.81% weighting)

Industrials (3.22% weighting)

Utilities (1.17% weighting)

Is anything sticking out to you?

Utilities. We can remove the utilities without thinking. They have no chance of beating the QQQs over time. This frees up 1.17% cash to re-deploy elsewhere.

Industrials. I’m going to keep it simple. If the revenue of any company in the industrial sector has not grown more than 5% per year since 2012, I’m removing it. It’s highly unlikely that a company that hasn’t been able to grow the top line materially is going to outperform the QQQs long term (we may let some company stay if they were growing nicely but just got nuked by Covid - let’s see).

There are 8 industrials in the QQQ: Honeywell; CSX; Cintas; Old Dominion; Fastenal; Verisk Analytics; Paccar; and Copart.

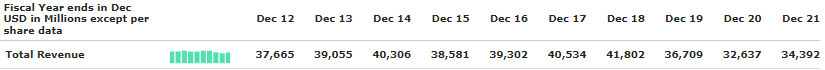

Honeywell

Honeywell is obviously toast.

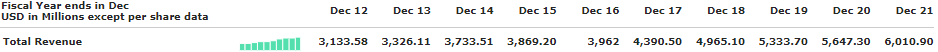

CSX

CSX is obviously toast.

Cintas

Cintas gets to stay. Old Dominion

Stays.

Fastenal

Stays.

Verisk Analytics

Stays.

Paccar

Paccar barely doesn’t make it, but it got nuked by Covid so we’ll let it stay.

Copart

Stays.

Net-net, we remove: Honeywell and CSX. Honeywell and CSX represent 1.64% of the index, so now we have 1.64% + 1.17% = 2.81% Cash to re-deploy.

Consumer Staples. There are 7 consumer staples businesses: Costco, Pepsi, Mondelez, Keurig Dr Pepper, Kraft Heinz, Walgreens and Monster. The only company I’m remotely tempted to keep from this sector is Costco. Costco is a world-class business and is the undisputed champion of the wholesale consumer goods market. That being said, it has been bid to the sky because it is so well run and seen as a supreme defensive play - and it’s trading at a forward multiple of 38. Given its space/multiple I don’t see much likelihood of it matching the QQQs from here. This entire sector is gone - giving us 5.81% cash to re-deploy, and bringing our total cash now to 8.62%.

Healthcare. This sector includes: Amgen; Intuitive Surgical; Gilead; Regeneron; Vertex; Moderna; Illumina; Idexx Labs; Dexcom; AstraZeneca; Align Technology; Biogen; Seagen. Healthcare companies (especially the ones in the QQQs) are a trickier beast. There is a chance that one of them develops a new blockbuster and takes off. The companies that appear to be overpriced have smaller marketcaps - so our opportunity cost of keeping them is low. Companies like Dexcom (which makes continuous glucose monitors) and Illumina (which makes machines for genomic analysis) have huge tailwinds. I’m going to leave the entire sector in our index.

Consumer Discretionary. This sector includes: Amazon; Tesla; Starbucks; Booking Holdings; Marriott International; Airbnb; MercadoLibre; O’Reilly Automotive; Lucid Group; Lululemon; JD.com; Dollar Tree; eBay; Ross Stores; Pinduoduo. The easy ones to remove from this group are Marriott (bad space), eBay (one of the world’s most poorly run businesses whose lunch is being eaten by Facebook Marketplace), and Booking Holdings (Google is eating its lunch). I’m going to remove Lululemon because no clothing company outside of Nike has any place in a long term portfolio. Dollar Tree and Ross Stores are gone - I have less conviction removing them but I just can’t bring myself to leave retailers in our index given the underlying business economics, the competitive nature of the space - and their potential TAM. I don’t know enough about JD/Pinduoduo/Lucid to remove them so they’re staying in by default, though it does make me cringe to leave Lucid - a $40B company that did $27m in revenue last year.

Net-net, Booking Holdings, Marriott, eBay, Lululemon, Dollar Tree, Ross Stores are gone - providing us with 2.194% cash to re-deploy, and bringing our total cash to: 10.814%.

Communication Services. This sector includes: Google; Facebook; Comcast; T-Mobile; Netflix; Charter; Activision; Electronic Arts; Baidu; Sirius XM; Match Group and NetEase. This section’s easy. Comcast, T-Mobile, Charter and Sirius XM are gone. These companies are simply not competing in spaces that offer the opportunity to keep up with the QQQs long term. T-Mobile has had an incredible run (and has actually crushed the QQQs over the past ten years) - but the easy gains are gone - the returns were so extreme because it went from being on the verge of bankruptcy to being a major (probably #2 eventually) player in Telecom.

Net-net, Comcast, T-Mobile, Charter and Sirius give us 3.942% to re-deploy, bringing our total to: 14.756%.

Information Technology. The big dog. As with the industrials I’m going to keep it simple. Any company in this sector that hasn’t grown at 5%+ over the past ten years is out - with one exception. If the company is in the business of making semiconductors they get to stay - the tailwinds are too strong to risk removing a semiconductor business. This sector includes: Apple; Microsoft; Nvidia; Broadcom; Cisco; Adobe, Intel; AMD; Qualcomm; Texas Instruments; Intuit; PayPal; Applied Materials; ADP; Micron; Analog Devices; Lam Research; Fiserve; Marvell; Palo Alto Networks; KLA Corp; ASML; NXP Semiconductors; Fortinet; Cognizant; Paychex; Synopsys; Workday; Autodesk; Microchip; Cadence Design Systems; Crowdstrike; Atlassian; Datadog; Zscaler; Ansys; Zoom; Verisign; Okta; Skyworks; Splunk and DocuSign.

I’m not going to post the 10 year revenue for the sake of brevity, but using the 5% rule we remove the following companies:

Cisco

ADP

Verisign

Net-net we have another 2.775% cash to re-deploy, bringing our total to: 17.531%.

17.531% is a large enough allocation to make a real difference over time. The businesses we have removed are highly unlikely to keep up with the businesses that remain. Now what do we do with the cash?

Step 2: Overweight Semiconductors

If you’ve been getting my posts you know how bullish I am on semiconductors (linking bull thesis here again for easy reference). Just one mega-trend (5G) has the potential to dramatically expand the TAM for virtually every single semiconductor business (my post on that linked here). But so do other mega-trends like the proliferation of electric vehicles, driverless cars, hyperscalers (cloud growth), internet of things (IoT), AI/ML, AR/VR, and the list goes on. All roads lead to semiconductors is an ongoing theme in my writing and there will certainly be more posts where I speak to it in the future - but for this post we’ll just take it as a given that semiconductors (as a whole) will at the least outperform the companies we’ve removed from the index.

The semiconductor companies in the QQQ are the following:

Nvidia (3.9% weighting)

Broadcom (1.953% weighting)

Intel (1.459% weighting)

AMD (1.431% weighting)

Qualcomm (1.293% weighting)

Texas Instruments (1.274% weighting)

Applied Materials (.899% weighting)

Micron Technology (.655% weighting)

Analog Devices (.649% weighting)

Lam Research (.546% weighting)

Marvell Technology (.434% weighting)

KLA Corp (.404% weighting)

ASML (.387% weighting)

NXP Semiconductor (.38% weighting)

Synopsys (.349% weighting)

Microchip Technologies (.318% weighting)

Cadence Design Systems (.316% weighting)

Skyworks Solutions (.166% weighting)

Total semiconductor weighting: 16.813%

So, where do we start? I want to cap semiconductor exposure at 30%, which means we’re going to deploy 13.187% of our 17.531% cash across the group. I’m going to keep it simple, and allocate that cash according to the weightings in the semiconductor index (SMH) with three exceptions. First, I am going to cut the addition to Nvidia by 75% because it already makes up such a large portion of the QQQ and is trading at a huge premium to every other semiconductor business. Second, I am not going to add anything to Micron - which faces more competition and competes in a less attractive market (memory) than the other large allocations in the index. Third, I’m not going to add anything to Intel - which is currently having its lunch eaten by AMD and has severe manufacturing problems at the same time as it’s ramping capex and hemorrhaging margin. I’m going to re-allocate what I cut from Nvidia Micron, and Intel to the US based semiconductor capital equipment companies (AMAT, LRCX, KLAC).

SMH holdings:

TSM (10.07%) - 10.07% X 13.187% = 1.33% added to index

NVDA (9.34%) - 9.34% X .25% X 13.187% = .32% added to index (.92% left to re-deploy)

AMD (8.4%) - 1.11% added to index

AVGO (6.12%) - .81% added to index

INTC (5.35%) - 0% added to index (.71% left to re-deploy)

TXN (5.33%) - .70% added to index

MU (4.95%) - 0% added to index (.65% left to re-deploy)

QCOM (4.89%) - .64% added to index

ASML (4.8%) - .63% ad

ADI (4.55%) - .60% added to index

AMAT (4.43%) - .58% added to index + .86% from NVDA/MU/

LRCX (3.85%) - .51% added to index + .74% from NVDA/MU

NXPI (3.74%) - .49% added to index

MRVL (3.54%) - .47% added to index

KLAC (3.48%) - .46% added to index + .67% from NVDA/MU

SNPS (3.13%) - .41% added to index

CDNS (2.69%) - .35% added to index

MCHP (2.68%) - .35% added to index

STM (2.33%) - .31% added to index

ON (1.6%) - .21% added to index

SWKS (1.6%) - .21% added to index

TER (1.42%) - .19% added to index

QRVO (1.03%) - .14% added to index

OLED (.54%) - .07% added to index

Total added to index: 13.187%

New semiconductor weighting: 30%

Remaining cash: 4.344%

Step 3: re-allocate remaining cash

The remaining cash is going to be spread equally across the remaining companies in the index (excluding the semiconductor companies we already over-weighted).

The final product is below:

Apple - 12.88%

Microsoft - 10.91%

Google - 8.25%

Amazon - 7.57%

Nvidia - 4.41%

Tesla - 4.08%

Meta Platforms - 3.44%

Broadcom - 2.86%

AMD - 2.61%

Applied Materials - 2.38%

Texas Instruments - 2.04%

Qualcomm - 2%

Lam Research - 1.82%

Adobe - 1.68%

KLA Corp - 1.55%

Intel - 1.464%

TSM - 1.33%

Analog Devices - 1.28%

Netflix - 1.28%

Amgen - 1.1%

Intuit - 1.05%

ASML - 1.04%

PayPal - .99%

Marvell - .93%

NXP Semiconductor - .89%

Starbucks - .82%

Intuitive Surgical - .81%

Synopsys - .78%

Micron - .69%

Microchip - .68%

Cadence Design Systems - .68%

Gilead - .61%

Regeneron - .59%

Fiserv - .53%

Vertex Pharmaceuticals - .53%

Activision Blizzard - .52%

Moderna - .5%

Palo Alto Networks - .45%

Airbnb - .41%

Illumina - .41%

MercadoLibre - .4%

O’Reilly Automotive - .39%

Fortinet - .39%

Cognizant - .39%

Skyworks - .38%

Paychex - .37%

Workday - .36%

IDEXX Labs - .36%

Autodesk - .36%

Dexcom - .34%

Cintas - .33%

Crowdstrike - .33%

STM - .31%

Lucid - .3%

AstraZeneca - .3%

Old Dominion Freight - .3%

Atlassian - .29%

Electronic Arts - .29%

JD.com - .29%

Fastenal - .27%

Datadog - .26%

Align Technology - .26%

Verisk Analytics - .26%

Paccar Inc - .26%

Biogen - .24%

Copart - .24%

Zscaler - .23%

Baidu - .22%

ANSYS - .22%

Seagen - .21%

On Semi - .21%

Match Group - .21%

Zoom - .2%

VeriSign - .19%

Teradyne - .19%

Okta - .18%

Netease - .18%

Splunk - .15%

Qorvo - .14%

DocuSign - .13%

Pinduoduo - .1%

Oled - .07%

It’s beautiful isn’t it? I’m going to be investing my 401k in this portfolio and publishing the performance on a monthly basis, tracking its performance against the QQQ, the SPY, and the VTI.

I think more actively managed equity funds will beat QQQ in next 10 years. QQQ is heavily skewed to the 4 $1 trillion big tech stocks. It may catch next bunch of $10 trillion winners, but those winners' contributions to the overall return will be relatively small, unless the current winners turn to next $10 trillion winners.