All posts are for illustrative, informational and entertainment purposes only, and should never be considered as investment advice. No assumption should be made that any company mentioned herein will be a good investment. All companies can go to zero!

Apple – the iPhone maker – has a single point of failure: Taiwan Semiconductor (henceforth “TSMC”). TSMC makes the semiconductors Apple’s products rely on, and without TSMC Apple’s business would grind to a halt. It seems like an uncharacteristically precarious position for the king of supply chains (Tim Cook) to find himself in, no?

Tim Cook is in that position not because he wants to be, but because he has no choice. Apple isn’t the only company to find themself in this position, and the list of companies that do is filled with household names.

1. Apple

2. Mediatek

3. AMD

4. Qualcomm

5. Broadcom

6. Nvidia

7. Intel

8. Amazon

9. Many auto companies (Partial point of failure)

Every single one of the above-named companies has now outsourced the manufacturing of their most advanced chips to TSMC. Even Intel! Why? Because chip making is hard. Literally, it’s the hardest most complicated and most expensive thing humans do, and there is only one company capable of making cutting edge logic chips (CPUs for example) at scale. Google, Microsoft and Facebook would also make an appearance on that list if you include companies who rely on Nvidia, Intel and AMD for their data center chips.

You might have heard of the recent CHIPS Act – whereby the US government is going to subsidize building production capacity (and a bit of R&D) to reduce reliance on the non-EU/US parts of the supply chain. This Act is a teeny tiny baby step in the right direction, but it doesn’t really move the needle. It is providing $52 billion in subsidies over 5 years, or $10.4 billion per year. TSMC’s capex last year was over $30 billion and it is going to spend between $40 and $44 billion in 2022. It is a single business!

Besides that, the entire country of Taiwan is one gigantic semiconductor subsidy. Semiconductors require an enormous amount of water to manufacture. If Taiwan runs out of water due to a weird weather pattern, guess what happens… Chips are prioritized above all else. During a recent draught domestic use of water was rationed and water was diverted from farmers to make sure they could keep producing chips! Obviously, this would never happen in the US. Another example is Taiwan’s high-speed rail network. Each district with a fab can be accessed quickly and inexpensively from any other district, making it easy and cost effective for engineers to be where they are most needed.

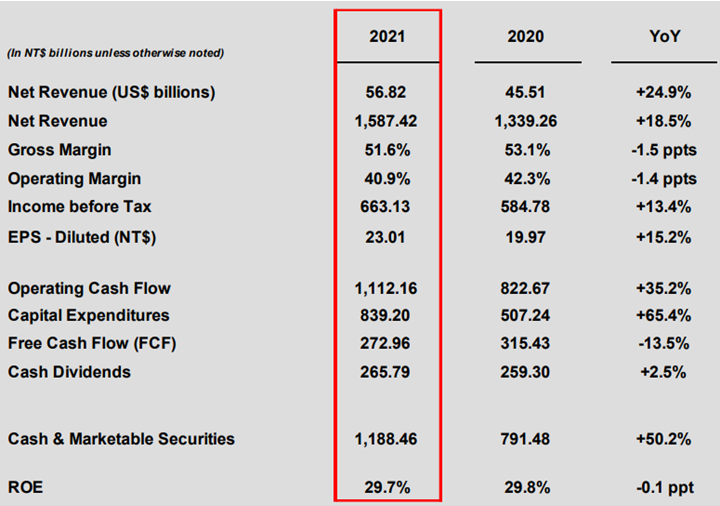

If TSMC is the only company on Earth that can make cutting edge logic chips at scale, does that mean it’s a monopoly? Essentially, yes. And it has the margins to prove it.

Last year Intel, Nvidia and Qualcomm all announced they were moving their most advanced chips to TSMC. The fact that a company spending $30 billion + per year can maintain operating margins north of 40% is astonishing, but less so once you realize that it is a monopoly.

TSMC is forecasting Q1 2022 revenue to be between $16.6 and $17.2 billion, with operating margins between 42% and 44%. Consensus Wall St estimates for 2022 EPS come in at $5.51 per share. This puts the company at a multiple of 22X 2022 expected earnings – which is exactly the same 2022 expected multiple of the S&P 500 (according to YCharts).

The S&P is expected to collectively grow earnings at 9% in 2022. TSMC had earnings of $4.11 last year, which puts its expected growth rate at 34%. How long can TSMC keep outgrowing the S&P? Let’s look at where growth came from last year as a starting point.

#1 Automotive

All cars need chips these days. The number of chips in a car is up 10X from where it was a few decades ago, and with the proliferation of EVs that number will surely continue skyrocketing.

Electric vehicle sales increased 108% YoY to 6.75 million units. EV sales drive demand for TSMC chips in two ways:

A. Directly – it makes a lot of the chips that go into cars, and its capacity limitations are largely responsible for the skyrocketing price of used cars (and lack of supply of new cars) we’ve seen this past year

B. Indirectly - data generated by electric cars exceeds that generated by gas cars by an order of magnitude. A lot of this data ends up in data centers, which means that it’s being processed and analyzed by chips made at TSMC.

#2 High Performance Computing (HPC)

This group includes Nvidia, AMD, Amazon, etc. Indirectly, this group includes Microsoft, Facebook and Google who buy chips from Nvidia and AMD. The expected growth rate of hyperscalers (another word for the tech giants who build most of the world’s data centers) is again north of 20% for 2022.

Whatever the market growth rate is for any of the above segments, TSMC will grow faster (unless it chooses to suppress one sector to focus on another due to capacity limitations). That’s because as of about two years ago, it became the only company on Earth capable of making cutting edge logic chips at scale. Any company designing a cutting-edge logic chip will be forced to sign up with TSMC (if they want reliable supply).

Some people think Intel can catch up in a few years, but I seriously doubt it. Remember the size of TSMC’s capex budget ($40-44Billion this year alone!) and Taiwan being a country-size semiconductor subsidy? I don’t think Intel thinks it can catch up either. It is having TSMC build a custom, $20 billion+ fab exclusively to produce its own next generation of Intel chips. To me, this indicates that Intel has admitted it is simply no longer possible to keep up. While they will still always say publicly that they will “not just catch up but surpass” TSMC in the future, that’s mostly to keep them from losing customers and the stock market’s faith. If it was hard to catch up already, putting $20 billion+ into the hands of their greatest competitor and thereby giving TSMC even bigger economies of scale advantages will only make it harder.

The strongest argument that can be made against investing in TSMC is that it is located in Taiwan – which China sees as a rogue province that it wants to bring back under its control. I believe that at some point Taiwan might become a part of China again (could be a few years from now, could be decades, I don’t have an opinion on the timeline). However, I also think that when/if it happens it will be done peacefully. I’m not saying there won’t be protests, but if there are protests, then the militaries of China and Taiwan will both be working together to keep the peace, not fighting each other. As China’s economy gets bigger and bigger, it will become easier and easier for China to offer a deal that – at least a majority of the Taiwanese – will not be able to refuse. It may be rocky, but it won’t result in anything that looks like a military conflict.

Further, any reunification would not put a stop to TSMC’s production. It isn’t just the US who is reliant on the chips they produce. It is the entire world, including China. If China were to invade Taiwan and try to take over TSMC, TSMC’s fabs would become useless. The technologies that are required to run TSMC’s fabs (Extreme Ultraviolet Lithography machines as one example) are sourced in large part from the US and Europe, and China would lose access to those technologies if they were to act in such a way that offended the world. Hence, the biggest risk would likely be a re-rating in the multiple investors are willing to give TSMC – similar to how many Chinese companies like Alibaba and Tencent trade at large discounts to their American peers.

When it comes to TSMC it is truly a Mutually Assured Destruction scenario – hence – whatever happens - it won’t be shut down.

The rapid advancements in AI and Machine learning make data ever more valuable, which makes the chips that run everything more valuable. Today, Apple accounts for about a quarter of TSMCs revenue, and the smartphone market accounts for 44% of total revenues. The HPC market currently represents 37%. I think this is going to flip sometime in the next couple of years (or sooner). All major trends point to an explosion of data creation, and this data will find it’s way into data centers and then through cutting edge logic chips.

Below I have pulled a slide out of ARK Invests 2022 Big Ideas presentation – which I highly recommend watching. While I don’t agree with their takeaways in terms of the best investments, and while their forecasts are always near peak bullish, the research is quite interesting and I think they get a lot of the big picture stuff more right than most. They are a shop that does understand exponential growth.

TSMC (and the designers of cutting-edge logic chips) find themselves in an enviable position. The cost of their chips is tiny relative to the value they deliver. Imagine you have a formula for shampoo that includes 10 ingredients, and one of the ingredients is responsible for only 5% of the cost of the shampoo. If that ingredient goes up 20%, the cost of the bottle has only increased by 1%. If that’s the key ingredient, you can be damn sure the producer won’t bother changing formulas. In fact, it will probably be willing to eat a much larger price increase to ensure its supply is not disrupted in the future.

Summary points to close:

1. Cutting edge logic chips are crucial to every facet of life today, powering everything from our mobile phones and laptops to the data centers that run Windows, power Netflix’ recommendation algorithm and host the world’s websites

2. In the future, cutting edge logic chips will become even more crucial as AI proliferates, 5G causes an explosion of data creation, and new markets come online (e.g. gene sequencing, AR/VR, etc)

3. Only one company can make cutting edge logic chips today

4. It’s possible that only one company will be able to make cutting edge logic chips for the next 5-10 years or more

5. That company is trading at the same price as the average business in the S&P 500