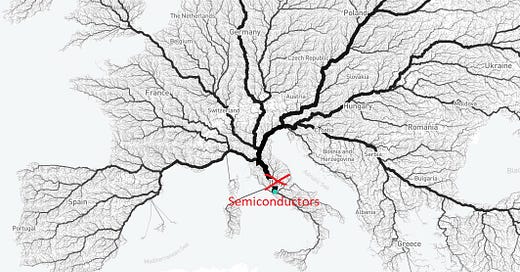

Original Image from Arch Daily (red writing is mine)

From Charles Leavitt @ the Center for Italian Studies, Notre Dame

The proverb “All roads lead to Rome” derives from medieval Latin. It was first recorded in writing in 1175 by Alain de Lille, a French theologian and poet, whose Liber Parabolarum renders it as ‘mille viae ducunt homines per saecula Romam’ (a thousand roads lead men forever to Rome).

“All roads lead to ‘X’ is a heuristic savvy long-term investors should keep in their quiver. Whenever a company pops up repeatedly as the best way to play/get exposure to _______; I take notice. Today, semiconductors generally seem like one of the best ways to play a variety of what I expect will be decade long mega-trends.

Ten years from now the world will look as if it has gone through Calvin’s (as in Hobbes) transmogrification machine. Entire industries will be unrecognizable. Technology broadly will be many magnitudes “spookier” than it already feels today. Healthcare will have finally found its footing as an information technology and will be benefiting from exponential growth. Healthcare might actually start to deserve its name. Computers will have passed the Turing Test. And, it is virtually certain that an individual company (odds on there will be more than 1) will have reached a $10 trillion valuation.

What does this mean for semiconductors? Let’s start with an anecdote: Amazon.

Amazon market capitalization January 2019: $875 billion

Amazon 2019 annual revenue: $281 billion

Online anything requires more semiconductors than in-person anything. But I want to make a broader point.

Companies selling products online must: 1) host their website (AWS); 2) maintain a vast library of product photos and videos for advertising and a/b testing (AWS); 3) subscribe to SaaS products that allow them to: a) interact with customers (Salesforce/Twilio); b) handle accounting (Intuit); c) manage inventory and shipping (Amazon); d) host virtual company meetings (Zoom); e) create graphic designs (Adobe); f) store files (iCloud); g) collect payments (Stripe)…Those are just the ones that immediately popped in my head.

Here’s the thing though. Salesforce, Twilio, Intuit, Zoom, Adobe, iCloud and Stripe are all AWS customers. All roads lead back to Amazon.

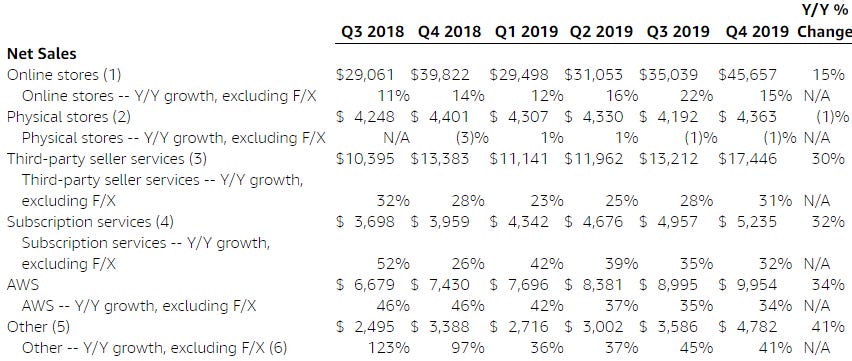

AWS sales finished 2018 at an annual run rate (which I’m defining as Q4 X 4) of: $29,720

AWS sales finished 2019 at an annual run rate of: $39,816

AWS sales finished 2020: $50,968

AWS sales finished 2021: $71,156

Amazon market capitalization January 2022: $1.5 trillion

Amazon 2022 expected revenue: $541 billion

AWS sales have gone up 2.4X since Q4 of 2018. AWS is a business that could alternatively be described as semiconductors as a service. After all, that’s what it does. It buys semiconductors and makes it easy for companies to use them as needed.

Before continuing I need to explain the difference between Analog and Digital semiconductors.

I found the following from Semtech:

The semiconductor industry is broadly divided into analog and digital semiconductor products. Analog semiconductors condition and regulate “real world” functions such as temperature, speed, sound and electrical current. Digital semiconductors process binary information, such as that used by computers. Mixed-signal devices incorporate both analog and digital functions into a single chip and provide the ability for digital electronics to interface with the outside world. The market for analog and mixed-signal semiconductors differs from the market for digital semiconductors. The analog and mixed-signal industry is typically characterized by longer product life cycles than the digital industry. In addition, analog semiconductor manufacturers tend to have lower capital investment requirements for manufacturing because their facilities tend to be less dependent than digital producers on state-of-the-art production equipment to manufacture leading edge process technologies.

I think both types of semiconductors will grow faster than the market expects but right now we’re talking about AWS and AWS uses digital semiconductors. There is one more distinction we need to understand within the digital category: memory vs. logic. Memory chips are less complicated and more of a commodity product. Memory is used to store data. Logic chips are literally the most complicated machines ever created by humans. Logic chips process data.

The biggest end users of logic chips are mobile phone manufacturers (Apple and Samsung) and hyperscalers (Google, Amazon, Microsoft, Meta).

This leads many people to a (logical but wrong) conclusion. Logic chips are risky business because the companies above have more negotiating leverage than any companies on Earth. When it comes to cutting edge logic chips demand is greater than supply and this will be the case for years to come.

Think of it like this. Two people (each of whom have billionaire parents) get married and move into a neighborhood where the average home sells for $300,000. The following year the home next door goes up for sale, and the couple finds out they’re going to have a baby. BOTH sets of billionaire parents (soon to be grandparents) decide they want to live next door. What’s more? Each set of billionaire parents sees the other (set of parents) as a fierce competitor for the young couple’s love and attention. Naturally, a bidding war ensues. Relative to their resources the house costs nothing, and the utility is tremendous. And it will give them a competitive advantage against the other set of parents in their battle for attention. The billionaires have almost incomprehensible financial might, but that won’t make any difference when it comes to buying the house - there’s going to be a bidding war of epic proportions! They don’t care about price, they just want the house.

One more anecdote pulled directly from another post I wrote on Taiwan Semiconductor. Imagine you own a business that makes the world’s best selling shampoo. The shampoo requires 10 ingredients, and one of the ingredients - the most special ingredient - is responsible for only 5% of the total cost. If that ingredient goes up 20% then the cost of the shampoo has increased by only 1%. You can be damn sure it won’t be worth changing formulas. In fact, you will probably be willing to eat a much larger price increase to ensure its supply is not disrupted in the future.

Amazon’s AWS, Microsoft’s Azure and Google’s Cloud are all growing around 40%. Their combined run rate is almost $140 billion. Do you see it now?

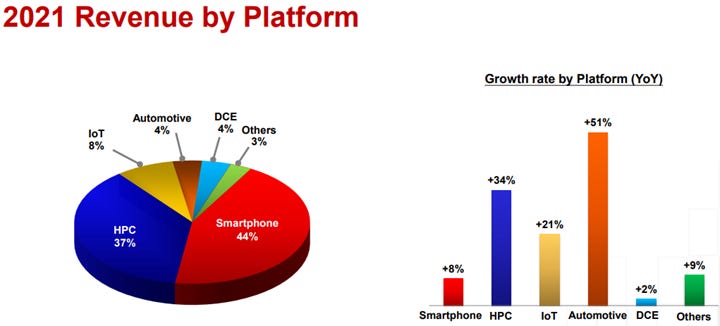

Look at the operating margins of some key semiconductor companies:

Taiwan Semiconductor (TSM)(manufactures chips): 41%

Nvidia (designs chips): 37% up from 27% last year

AMD (designs chips): 25% up from 17% last year

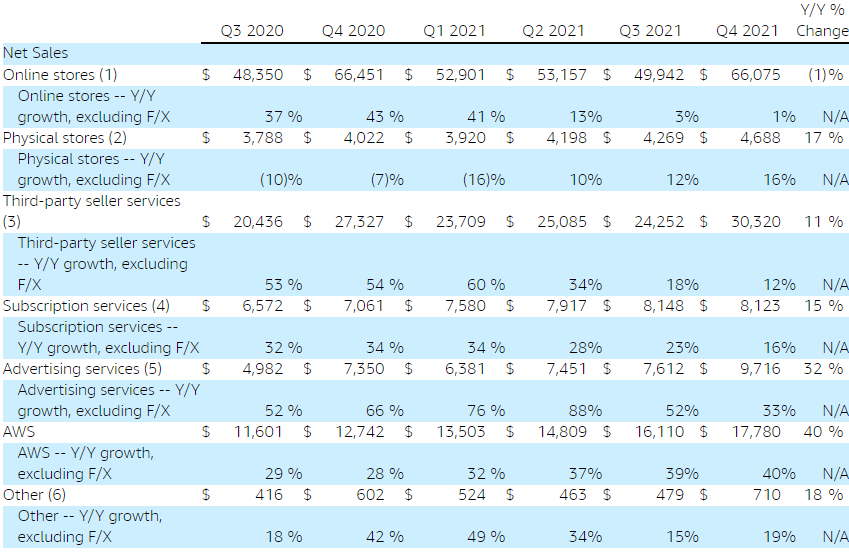

Why are Nvidia and AMD’s margins increasing? In part because data centers are the most profitable buyers of cutting edge logic chips (which AMD/Nvidia design and pay TSM to manufacture) - and they’re (data centers) growing fast (HPC is the segment they’d fall under in the below image showing TSM’s revenue distribution).

TSM’s HPC segment would have grown even faster if it had not been capacity limited. It will spend $40-$44 billion this year on capex. A truly mind-numbing figure. And it still probably won’t be enough to satiate the demand of hyperscalers.

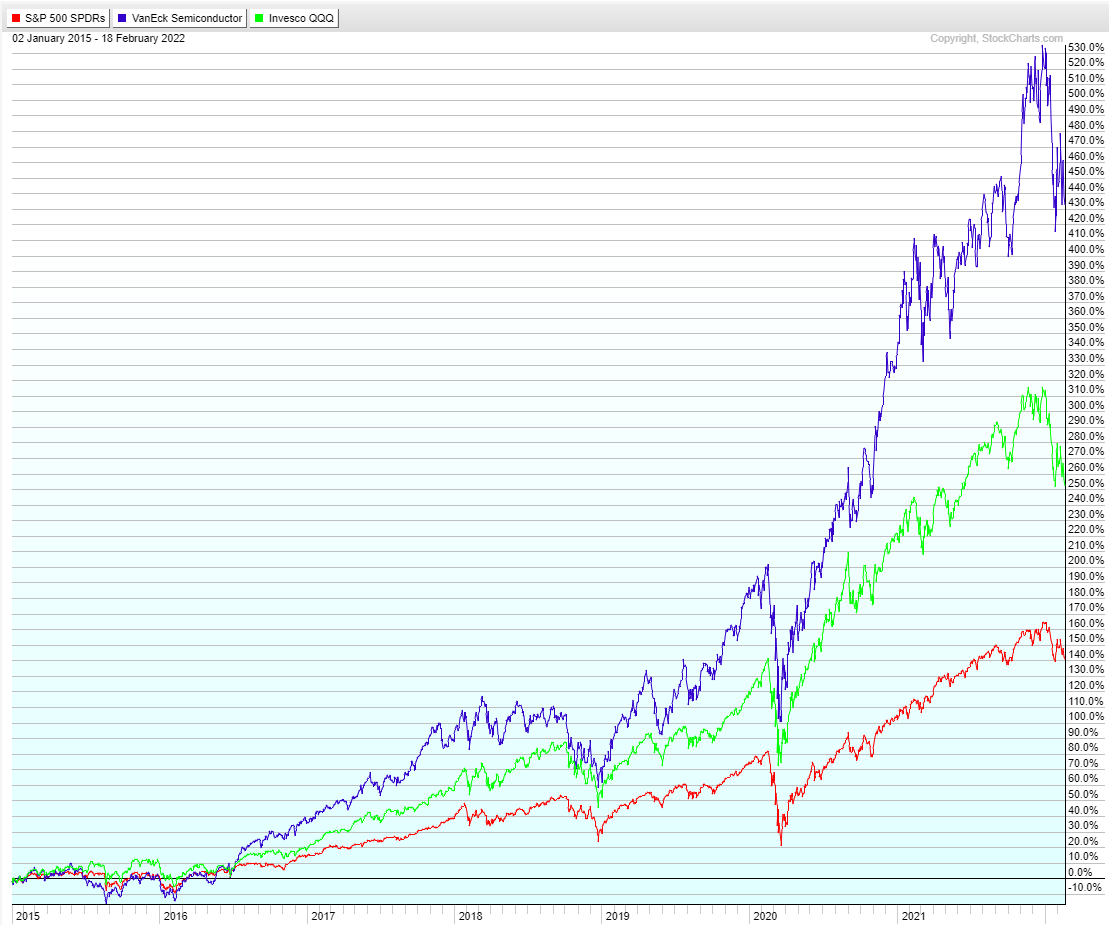

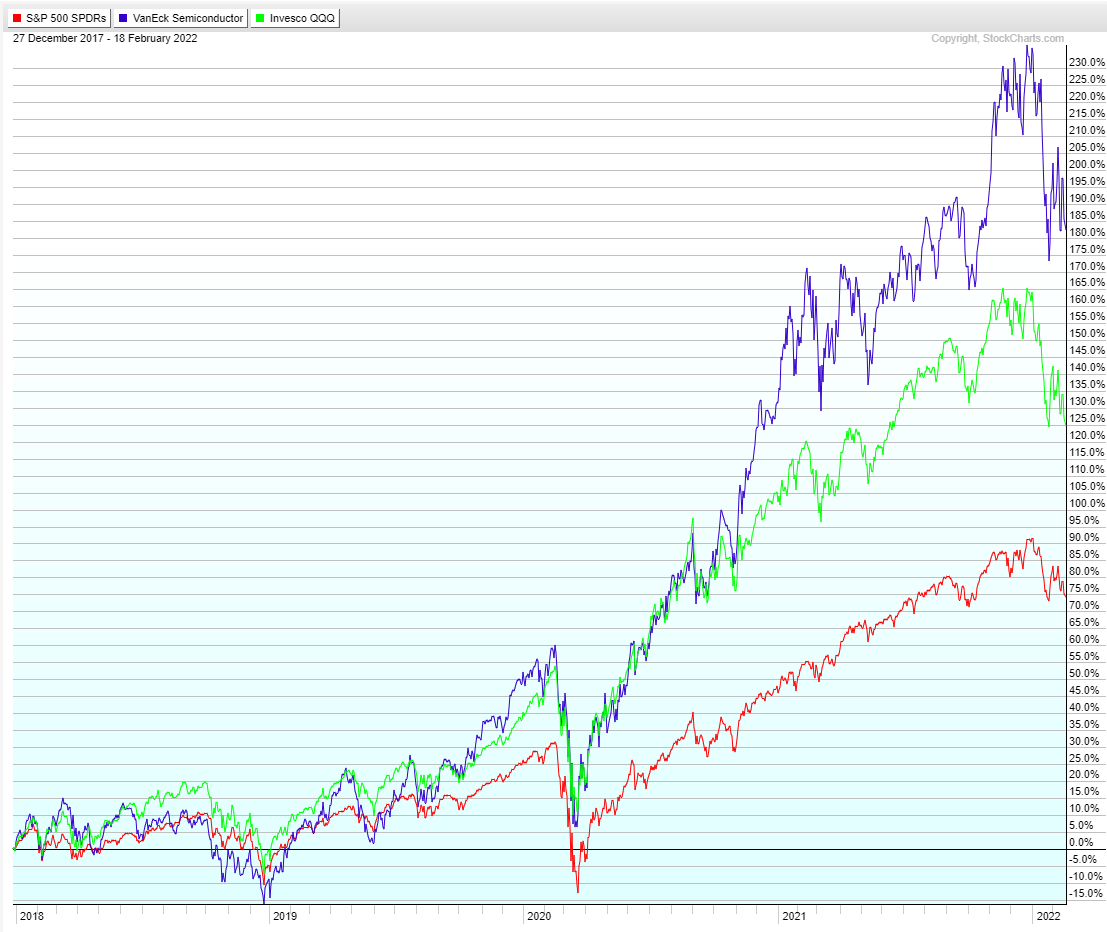

There is an easy way to get exposure to semiconductors if you don’t want to take individual stock risk. The SMH etf. It is the closest thing to a market-cap weighted semiconductor index. Below I show the historical performance of the SPY (S&P500) vs the QQQ (Nasdaq 100) vs the SMH:

Red is the S&P 500, Green is the Nasdaq 100, and Blue is the SMH

Since 2015

Since 2018

The top 5 holdings of the SMH and their last year operating margins are:

14% Taiwan Semiconductor (Operating Margin 41%)

10% Nvidia (Operating Margin 37%)

5.74% ASML (makes equipment for semiconductors; Operating Margin 41%):

5.08% Qualcomm (Operating Margin 32%)

4.99% AMD (Operating Margin 25%)

So far we’ve just been circling the rabbit hole. I’m going to conclude Part 1 by jumping in with both feet - looking at exponentials. Part 2 will explore specific trends and technologies that I think have the potential to make the past look passe, and make the future look fucking Biblical.

Alex Knapp (then of Forbes) wrote an article 10 years ago in which he recounted a story often used to explain exponentials. It’s about the inventor of the game Chess.

As the story goes, when the game Chess was presented to a great king, the king offered the inventor any reward that he wanted. The inventor asked that a single grain of rice be placed on the first square of the chessboard. Then two grains on the second square, four grains on the third, and so on. Doubling each time. The king, baffled by such a small price for a wonderful game, immediately agreed, and ordered the treasurer to pay the agreed upon sum. A week later, the inventor went before the king and asked why he had not received his reward. The king, outraged that the treasurer had disobeyed him, immediately summoned him and demanded to know why the inventor had not been paid. The treasurer explained that the sum could not be paid – by the time you got even halfway through the chessboard, the amount of grain required was more than the entire kingdom possessed.

There are 64 squares on a chessboard.

1. 1

2. 2

3. 4

4. 8

5. 16

6. 32

7. 64

8. 128

9. 256

10. 512

11. 1024

20. 524,288

30. 536,870,912 (million)

50. 562,949,953,421,312 (trillion)

64. 9,223,372,036,854,780,000 (quintillion)

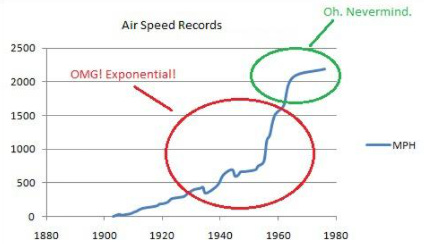

Full Disclosure: If you read Alex’ article you will see that the point he is making is exactly the opposite of the one I’m making. He uses the above example to explain that exponentials cannot continue forever. Eventually you run out of rice.

He proves his point by looking at airplanes. The speed at which they flew increased exponentially until we reached the physical limits of air travel.

But on deeper examination his argument falls apart. Air travel is a subset of the broader technology of “moving information” (humans – like all physical objects – are a form of information). We are most certainly getting better at moving information around at an exponential rate. Pointing out that physical objects specifically cannot keep traveling faster is like pointing out that computers run on vacuum tubes have stopped improving.

What has always increased exponentially, from the birth of single celled organisms straight up to Moore’s law, and what will continue to increase exponentially in the future, is information.

Even if you were to agree with Alex’ point from a theoretical/philosophical perspective (reasonable), what isn’t reasonable is thinking that anyone alive today will live to see the end of information’s exponential growth.

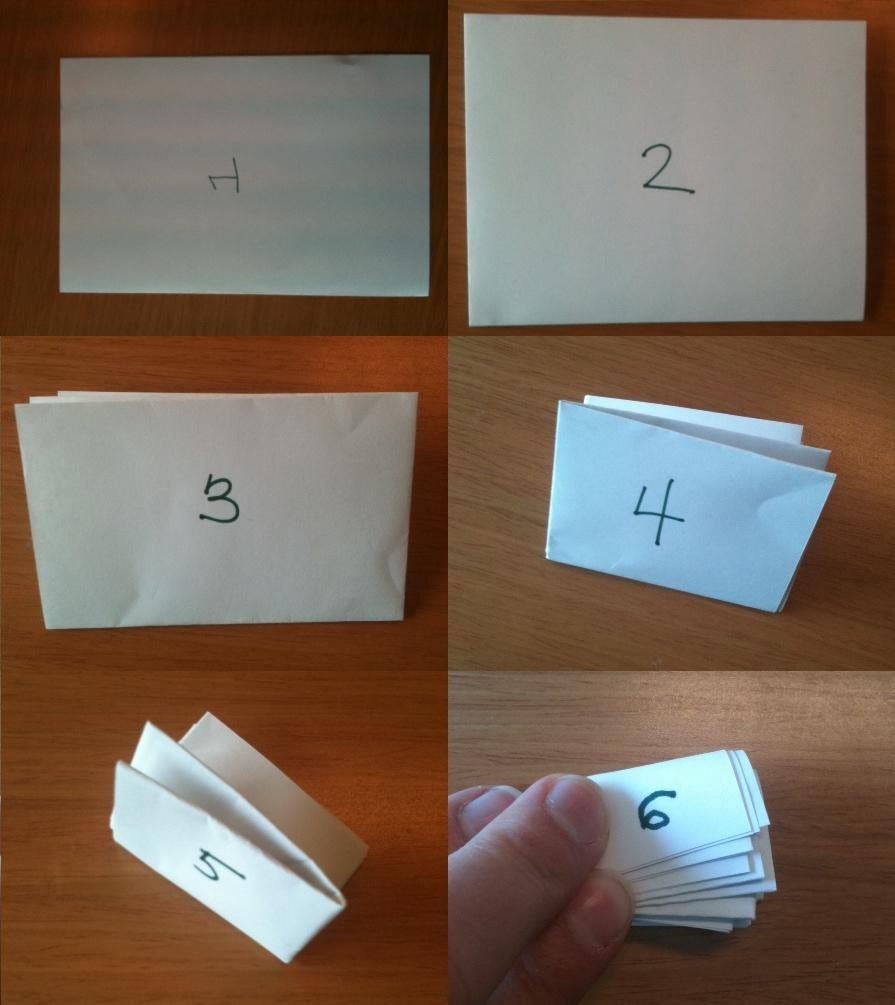

Let’s look at one more fun example to help us visualize exponential growth before moving on to the trends themselves: paper folding.

I’ve pulled images and text below from this delightful article by Ethan Siegel on Medium.

How many times would you have to fold a piece of paper .01cm thick onto itself to reach the Moon? The mean distance to the Moon from Earth is about 384,000 km, or – if we remember a page is .01 cm thick – about 3.84 X 10^12 pages away. So you’d expect that you’ll need an awful lot of foldings to get there, wouldn’t you?

Don’t be so hasty! When I start with an unfolded page (zero foldings), it’s one page thick. When I fold a page once, it will be two sheets thick. But – and this is key – when I fold it a second time on itself, it’s not three, but four sheets thick.

…By the time I’d get to 9 foldings, my folded paper would be thicker than a reem of 500 sheets of paper. By the time I’d get to 20 foldings, my folded paper would be more than 10 kilometers high, which surpasses Mt. Everest. If you keep going, you’ll be in outer space after 24 foldings, you could catch the Hubble Space telescope after 28, and after 41 foldings you’d finally be closer to the Moon than Earth. So…that means that 42 foldings is what it takes!

Let that last sentence sink in. It’s 41 foldings to get half way, but then only one more to cover the same amount of distance.

The more time passes, the bigger each step-change. We’re living on the back half of the chessboard.

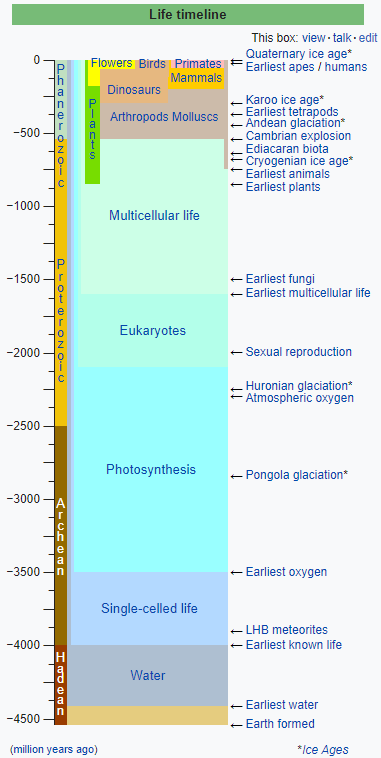

Let’s start at the beginning.

I’m not sure if he’s the first person who said it but brainyquote.com attributes the saying “the trend is your friend” to Martin Zweig. He’s correct. From a mathematical perspective the likeliest thing to happen tomorrow is a continuation of whatever was happening today. The sun will rise. You will be alive. Politics will be divisive. Etcetera. This is obvious.

The trend of information increasing exponentially has arguably been taking place since the inflationary period that preceded the big bang. However, we’ll start where the evidence is more readily identifiable: 4.5 billion years ago.

Looks exponential doesn’t it? It took from 4 billion years ago to about 1.6 billion years to go from single-celled life to multicellular life. It took almost another billion years to get our first animals. Took another 500 ish million to get to mammals. Mammals to primates was less than 200 million years, and primates to humans is a rounding error on the timeline. Another way to describe our evolutionary progress is: over time increasingly larger advances are being made over increasingly shorter periods. We’re living on the back half of the chessboard.

Has evolution has run out of rice?

No. Humans are simply one manifestation of the exponential increase in information, and information has already found a new way to progress that transcends biology (and information may yet find its way back to biology, but that’s a topic for another post).

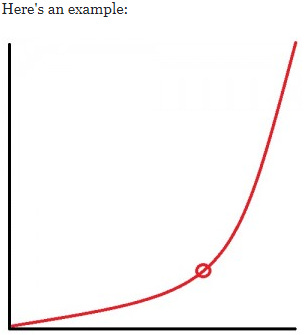

Knowing that information is growing at an exponential rate is not useful to investors in a vacuum. After all, even the longest-thinking investors must make their returns during their own lifetimes. However, it would be useful information if we (investors) were able to discern whether we are at the anthropomorphic knee of the curve.

The location of the “Knee” has to do with perspective. For an alien civilization that lives millions of years the knee would be in a different place than it would for humans who live less than 100. I think of the knee of the curve as being the point at which change over the course of one year becomes noticeable to the savvy eye.

Information moving speed has a absolute limit, light speed. Information moving throughput (like processor's instructions per second, memory bandwidth) is more relevant to computing and semiconductor. I'm not sure that can keep improving exponentially either.