NFTs: CryptoPunks vs. the Salvator Mundi, and the use case that’s attracting Instagram.

How big is the market opportunity?

Before I start, let me say that comparisons can aptly be made between NFTs and: financial bubbles, pet rocks, beanie babies, crypto shitcoins, ponzi schemes, lottery tickets, addictive substances, Heaven (for degenerate gamblers), AND the art of untalented children across the country that still finds itself magnetically fastened to the refrigerator – which has value only to the creator and the creator’s parents.

NFTs are – at the least – the single most fascinating case study around (degenerate) gambling the world has ever seen. There’s also a decent chance that they end up completely transforming entire markets and creating new ones. That being said, I have run across at least eight use cases for NFTs which are operational today:

1. NFTs for scam artists (the “Rug Pull”)

2. NFTs for degenerate gamblers

3. NFTs as Art

4. NFTs as luxury brands/goods

5. NFTs as membership-clubs

6. NFTs as ownership of intellectual property

7. NFTs as ownership of digital assets

8. NFTs as proxies for securities

In this post I’m going to specifically hone in on the intersections between [the creator economy] + [community dynamics] + [gambling], which I think combine to make a powerful cocktail of unpredictability. If I had to state a single objective for this post, it’s to convince you that shit can get far crazier than it is today. Not that it will…just that it can.

First we’ll lay some groundwork by looking at:

1. The ridiculousness of the traditional art market

2. Humans’ evolution-driven love of [being part of a community] and [gambling]

We’ll use #2 above to provide context for exploring two hypothetical use cases of NFTs from the perspective of Instagram.

Then I’ll comment briefly on the nature of fads and bubbles, and present a hypothesis around how the nature of NFTs means that they will likely have more staying power than Beanie Babies.

I’ll finish by walking you through the most successful NFT project - The Bored Ape Yacht Club (BAYC) - whose creator just raised a $450 million seed round at a $4 billion valuation.

Before we begin, a quick primer on what an NFT actually is.

NFT stands for non-fungible-token. Like cryptocurrencies, ownership of NFTs is recorded on a digital ledger (usually Ethereum). When you purchase a house the title is transferred from the seller to you. That transfer is usually recorded in the office of the county or municipal clerk. When you buy an NFT (or cryptocurrency) the transfer is recorded on the ledger – the digital equivalent of the county clerk.

The reason they are called non-fungible is because each NFT has a unique identifier – think of it like a social security number or DNA. Parents can have identical twins (NFTs can have the same JPEG image) – but if one of the twins murders someone and leaves their blood at the crime scene CSI investigators will still be able to figure out which one of them did it – even if they can’t tell by looking at the security footage. While there are millions of bitcoin – and 1 bitcoin will always equal 1 bitcoin – each NFT will always be one of a kind.

The ridiculousness of the traditional art market: What Cryptopunks and Salvator Mundi have in common

The painting below is known as Salvator Mundi. It was painted by Leonardo da Vinci (arguably, apparently there is some controversy but I didn’t dive into it).

It sold for $450 million to this guy in 2017:

Mohammed bin Salman (MBS) considers himself a student of Warren Buffett’s. That’s why he didn’t buy this painting before doing some due diligence. Being a savvy investor, MBS knew that purchasing the painting would only make sense if he could buy it below its intrinsic value (which Buffett defines as the discounted value of cash flows that can be taken out of an asset during its remaining life).

So, MBS hired Goldman Sachs (GS) in 2017 to analyze the past cash flows paid by the Salvator Mundi to its prior owners throughout history. He then asked GS analysts to forecast the expected future cash flows that would be paid to him if he became the painting’s new owner. After discounting the expected future cash flows back to the present using an 8.57% cost of capital (GS analysts like to be precise) it became obvious to MBS - a truly savvy, once in a generation investor - that $450 million was a steal.

Rumor has it that MBS was so excited about the huge dividends he was about to receive that he stayed up day and night staring at the painting, waiting for the money to start falling off his wall. Reportedly, his only fear was that the dividends would be paid in Ancient Venetian Ducats - which might be hard to convert into Saudi Riyal’s.

If you want a custom replica of the Salvator Mundi that would be indistinguishable to the original except under expert examination, it will set you back $10,000-$20,000. You can also right-click-save a large file size version on Google Images and have it blown up and printed it for around $100.

You might be thinking – Everyone has heard of Leonardo Da Vinci. He was the original renaissance man and one of the most famous historical figures of all time. Of course his painting is worth an enormous sum, it is a true one of a kind and the rarity value alone is astronomical…

Hold that thought. Here are some paintings by folks you probably haven’t heard of.

The piece below appears to show watermelon seeds and candle wax used to write the word Ripe on an old office folder. Painted by Ed Ruscha - this truly stunning work of art recently sold for $22,200,000.

Here’s another masterpiece, the “Onement VI” - better known as “Blue”. Barnett Newman is the genius behind this piece. In an interview Barnett said he was inspired by the ping-pong table at his old high school. It sold for $43.8 million.

This next work of art comes from a true once-in-a-century genius, Mark Rothko, known for his rectangles. It is said that he got the inspiration for his paintings by staring at the paint swatches his wife brought home from Sherwin Williams. It sold for $72.8 million.

Now, if you are a huge fan of rectangles but can’t shell out enough cash for three of them (and a black line to boot), you can purchase the two rectangles below for the bargain basement price of around $9 million.

You can also go to Home Depot and have paint swatches blown up with poor resolution.

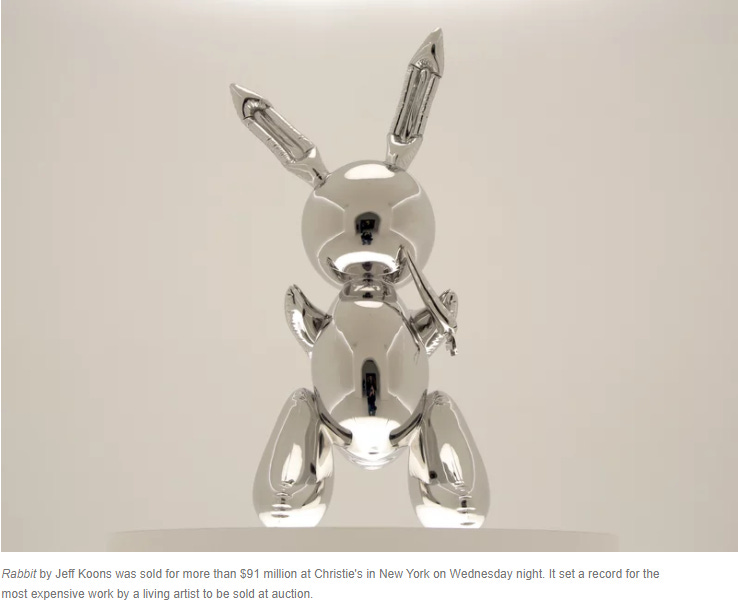

Paintings aren’t alone in drawing enormous sums. Below is a 3-foot-tall stainless steel bunny. It sold for $91 million at a Christie’s auction. It was made by a guy named Jeff Koons - who is still alive.

If you are drinking anything put it down so you don’t spit it out on your phone or keyboard when you read the ridiculous description found in Christie’s essay describing the bunny:

It is crisp and cool in its appearance, yet taps into the visual language of childhood, of all that is pure and innocent. Its lack of facial features renders it wholly inscrutable, but the forms themselves evoke fun and frivolity, an effect heightened by the crimps and dimples that have been translated into the stainless steel from which it has been made…The steel surface of the titular bunny initially appears smooth and balloon-like, the forms reduced to some abstract, Platonic ideal.

Hahahahahahahahahahahahahahahahahaha — what now?

With that preface, the following will probably seem at least a tiny bit less ridiculous.

Each of the below pixelated images is now worth in excess of $200,000 - and most by a large margin.

Below is a snippet from an article posted September 25th, 2020 by Robert Hoogendoorn:

Collectors and investors looking to get their hands on the cheapest of the ten thousand Cryptopunks need to pay at least one thousand dollars. According to the official website the cheapest Cryptopunk is listed for $2.99 ETH, which currently equals $1030.68. Collectors could obtain these artistic characters on the Ethereum blockchain for free back in 2017.

A few days ago the cheapest Cryptopunks were only $400. It’s very likely that the hype surrounding these limited edition digital collectibles now goes beyond the space of collectors and traders. These 24x24 pixel creations are becoming investments.

To my knowledge, Cryptopunks and Bored Apes are the fastest appreciating whatever you want to call thems in all of history. There are 10,000 Cryptopunks. The cheapest punk you can purchase today is 72.89 Ether, or $225,959. That means - at minimum - the collection is valued at 2.26 billion dollars.

As you will see below, the rarer NFTs from these collections sell for many times the floor price (floor price = the cheapest one you can buy).

The highest sale for a Cryptopunk was Punk #5822, which sold for $23.7 million on February 12th earlier this year:

The previous record holder was this punk which sold via auction at Sotheby’s in June of last year for $11.8 million:

Just for fun, let me try playing the role of Christie’s acid-dropping art school intern responsible for the bunny description…

This punk is modern yet retro in its appearance. Dating all the way back to 2017, the pixelated N-95 mask taps prophetically into the visual language of modern healthcare. Using only 576 pixels, the creator has masterfully ensured that not a one is waisted - a single pixel being transformed into a golden earring is the height of minimalistic design. The light sapphire-hued skin-tone anthropomorphizes the alien nature in all of us, and the beanie manifests as a potent reminder that even in a cold world - humans can find warmth.

Are $70 million rectangles and $90 million bunnies that different from a $12 million JPEG?

Humans love community

The human desire to be part of a community dates back to the first primates (at least) who discovered (unconsciously) through trial and error that living in a group increased reproductive capacity. A group had many eyes to watch out for predators. Many hands to take care of and teach offspring. Knowledge became exponentially more useful because it could be stored and passed throughout the community via memes (Richard Dawkins’ sense of the word). Over millions of years rebellious loners who strayed from their groups metaphorically castrated themselves by failing to reproduce with the same velocity as those who favored being part of the community.

The more primates evolved the more important community became. Primate communities were initially an evolutionary tool to compete against other animals. When Homo Sapiens left Africa and proliferated across the globe, community became the weapon one tribe used to dominate another. The primary reason philosophy and religion became so core to the growth of powerful empires was that they allowed a vast number of people to act cohesively and pool resources.

Pooling resources not only enabled specialization - it also facilitated the spread of literacy and gave people free time to think about the future rather than worry about where the next meal was coming from.

Between genes and memes the desire to be part of a community is so strong that a feeling of isolation has been associated with an increase in mortality risk on par with smoking and obesity. The below excerpt is pulled from an article on Webmd.com

Douglas Nemecek, MD, Cigna’s chief medical officer for behavioral health, said the findings of the study (conducted by Cigna) suggest that the problem (of loneliness) has reached “epidemic” proportions, rivaling the risks posed by tobacco and the nation’s ever-expanding waistline. “Loneliness has the same impact on mortality as smoking 15 cigarettes a day, making it even more dangerous than obesity,” he said in releasing the report.

Julianne Holt-Lunstad, PhD, a psychologist at Brigham Young University who studies loneliness and its health effects, has found loneliness makes premature death more likely for people of all ages.

In 2017, she presented new research linking loneliness and social isolation to a number of health risks at the American Psychological Association’s annual convention.

Her paper cited data from two analyses. The first tracked 148 studies, involving more than 300,000 participants, and found that greater social connection is associated with 50% lower odds of early death. The second, involving 70 studies representing more than 3.4 million people, found that social isolation, loneliness, or living alone boosted the chance of premature death at least as much as obesity.

I haven’t looked at these studies to investigate how they account for confounding factors, but intuitively I believe they are directionally accurate even if loneliness isn’t really as bad as smoking or having a BMI over 40.

Humans love gambling

The oldest six-sided dice was found in a tomb in Egypt that dated to 3,000 BC. Evidence of gambling houses and lotteries starts popping up around 1,000 BC. The Bible references guards “casting lots” (equivalent to throwing dice) to see who got to keep Jesus’ cloak.

According to Global Industry Analysts, Inc., (GIA) the global gambling market was around $700 billion as of 2020, and is projected to grow to nearly $900 billion by 2026.

Dopamine and other neurotransmitters are the evolutionary mechanic that rewards us for doing things that are crucial to our survival and proliferation - like having sex and eating food. Drugs and gambling also result in the release of dopamine. Countless bankruptcies have resulted from addictions to dopamine - whatever its source.

To summarize: humans need community and love gambling.

What platforms for creators (like Instagram) see in NFTs

In May of last year the viral video titled “Charlie bit my finger” was turned into an NFT and sold for $760,999 The video (linked here) had been viewed more than 880 million times.

Now it has become a piece of internet history. Prior to selling the NFT, the Davies-Carr family had earned around $140,000 from the video.

People pay obscene amounts of money for crazy things. Instagram has more than 2 billion users. At the least, Instagram giving their user base a new way to monetize viral content (outside of ads) should make the platform stickier. Creating an NFT still requires a high degree of technical expertise and at least one highly compensated programmer. But what if it didn’t? Let’s walk through a hypothetical.

Five years from now a fifteen year old amateur creator with only 437 followers uploads a video of her cat sleeping next to her pet mouse. The video goes viral. After 2 days it hits 10,000 views. The next day it hits 20,000. The creator gets a prompt from Instagram that says “Monetize your video by turning it into an NFT”. She clicks. The process is simple. She only has to do three things:

1. Pick a price for the NFT: She chooses $500

2. Pick how many shares she wants to divide the price into: She chooses 10,000

3. Pick a fee that she will charge in perpetuity each time someone sells the NFT to someone else: She chooses 5%

Instagram users watching the video now see a prompt pop up that says “buy a piece of this Video as an NFT for only $0.05” ($500 / 10,000). Purchasing the NFT is as simple as clicking a button and using a scroller to choose how many shares you want to buy.

How many viewers will click on it? Is it reasonable to assume that teenagers will impulse buy fractional ownership in a hilarious video if it only takes a click? Is it reasonable to assume that people will want to support the creators whose content they’re watching? Buying ownership in something feels different than donating money directly to the creator. $0.05 feels like you’re not even spending money. But…there’s some game theory here we haven’t explored yet. Our story isn’t over.

All 10,000 shares sell. The creator now has $450 in her pocket - $500 less the 10% fee Instagram takes. Enter new NFT owner X who purchased a share in the video for $0.05. They receive a notification upon completing their purchase that says: “Congratulations on purchasing NFT #10243! If you would like to sell your new NFT in the future just click the sell button highlighted in red and enter a price that you think is fair. If you want to see what other people are listing their NFT for you can click the button that says “marketplace” below.” NFT owner X looks at the view count of the video and sees that it has gone up to 100,000. She decides to go ahead and list the NFT she bought for $0.05 at a price of $5.00 just to see what happens. Thousands of other people who purchased fractional shares of the NFT do the same.

Enter new video watcher Y. New video watcher Y sees the video and thinks its hysterical. She sees that the video has 100,000 views but thinks it could have way more. New video watcher Y is a savvy social media user herself and has already bought and sold video NFTs before. $5.00 seems like a reasonable price to support this creator and new video watcher Y would happily pay it even if she didn’t think there was an opportunity for appreciation. She has nothing to lose and thinks she might make some money – so she pulls the trigger. Thousands of other people also pull the trigger. Now let’s do some napkin math:

1. 2 out of every 1,000 views result in a purchase

2. It takes 10 million total views for the price of the NFT to hit $10.00

3. By the time total views have hit 10 million the average purchase price of the NFTs has hit $5.00

10 million views less the 20,000 views at the time of listing = 9,980,000.

[2/1,000] X 9,980,000 = 19,960 transactions

19,960 transactions X $5.00 average transaction size = $99,800

Our NFT creator pockets 5% of transaction volume (less a 10% fee to Instagram) – so she has now made 5% X $99,800 = $4,990-$499 (10% fee) = $4,491 of income in addition to the initial $450.

Some people may be reading this hypothetical and think it sounds inevitable. Others certainly think it sounds ludicrous. But remember, people spend $700+ billion per year betting on the outcomes of elections, the weight of prize pigs, the outcome of sports matches and the likelihood that a roulette ball lands on red. Why wouldn’t they start betting on the virality of videos? Especially knowing that they are supporting the creator in the process…

Things are worth what people are willing to pay for them. Nothing more. Nothing less. Will the vast majority of NFTs like the one described in our hypothetical eventually go to zero? Obviously. But that does not mean the marketplace for NFTs won’t end up being sustainable.

The above anecdote is interesting because it paints a picture around how a non-professional creator with a small follower base and no experiencing monetizing through ads can make some money. I don’t know if Instagram will ever do anything like what I described. There’s obviously a significant amount of brand risk associated with giving people a new way to gamble – especially for a company owned by Facebook. If I were forced to bet – I would say that Instagram will NOT allow all users to create NFTs - at least not for a while…

What then is the use case for NFTs that is attracting Instagram?

Let’s consider a hypothetical up and coming musician, we’ll call her Justine Beaver. Justine has acquired 100,000 followers on Instagram with her videos that take the lyrics and tunes of classic rock songs and turn them into electronic techno-punk. Justine feels she is finally ready to release her own album and needs to raise a larger amount of money than she’s currently generating from her follower base. Justine has read about Instagram’s NFT Creator program and decides that it’s a better path forward than trying to sign with a record label - which would require her to largely give up control of her work and artistic direction. Justine decides to move forward and let her followers mint 5 types of NFTs - each of which she is able to create using a combination of simple explanatory videos and a point-and-click interface.

NFT type 1 gives its owner the right to 10% of all revenue generated by Justine’s new album. She lists it for $10,000.

NFT type 2 gives its owner back stage passes to all concerts for life. She lists it for $10,000.

NFT type 2 gives their owners the right to 1% of all revenue generated by Justine’s new album in perpetuity. She lists 20 of these for $1,000 each.

NFT type 3 gives their owners the right to attend 1 free in-person concert per year for life. She lists 1,000 of these for $100.

NFT type 4 is the equivalent of a baseball card. It’s just a picture of Justine and her guitar. Their value is tied to scarcity and their association to Justine’s “rookie season”. She lists 10,000 of these for $1.00.

The beauty of NFT technology is that the NFTs can be programmed to receive the above benefits automatically. Each time Justine’s album generates revenue her “bank” will seamlessly deliver the profit share directly to the wallet of the NFT holders. Fans using their NFTs as a concert ticket can have their unique identifiers verified at the door to the stadium - they are fraud proof.

It seems obvious that a popular social media artist would sell out all of the above doesn’t it? Kylie Jenner has become a billionaire through self-promotion on social media. Her cosmetics company did more than $400 million in sales in its first 18 months. The followers of creators will all be familiar with stories of influencers making it big, and they will let their imaginations run wild with the potential of future success. Worst case they are paying a reasonable sum to be a part of a community and support someone that brings them joy. But it will also feel like they’re buying something with lottery potential.

Justine would raise $10,000 + $10,000 + $20,000 + $100,000 + $10,000 = $150,000. But Justine also gets two more things:

A community that shares ownership in her future success - and which will act as dedicated brand ambassadors pumping out her content with a fervor that only ownership can inspire

An ongoing royalty (5%?) from sales each time her NFTs trade hands in the future (see example above)

When minting (initial issuance, equivalent to a stock IPO) an NFT becomes as simple as point-and-click, won’t virtually all content creators demand a user friendly platform for managing and creating them? The platform that helps creators monetize most effectively will be the one that wins.

It will soon be as easy to buy and sell NFTs as it is to buy and sell stocks on Robinhood. Demand that starts out from passionate followers wanting to be part of a community will expand to include demand by speculators (read: degenerate gamblers) aiming to bet on the next hot creator.

Just over 4 million people have ever purchased an NFT. Those people are driving $5 billion of monthly trading volume today. Buying an NFT is complex and requires paying huge transaction fees (the average fee on Ethereum during peak trading hours can be hundreds of dollars). What will happen when 2 billion people have the ability to gamble AND feel like they are becoming part of a community for as little as $0.05 with no trading fees?

Mega hedge-funds and family offices are buying into cryptocurrencies now. Is it impossible to imagine that ten years down the road (or less?) Goldman Sachs will have an NFT trading desk?

Now I’ll address a frequent opinion I run across - that NFTs are like Beanie Babies - a fad that will play itself out. I’m open to this possibility, but there is a strong counter-argument.

Beanie Babies represented a single community. A single fad. A single bubble. Everyone that spent enormous sums buying up Beanie Babies - and who subsequently lost their entire “investment” - will definitely not have any interest in partaking in another stuffed-animal bubble. But NFTs won’t feel like a single thing to their buyers. Each community will feel unique, a new opportunity to find a winner. A new opportunity to become part of a community.

Like the stock market - the appetite for speculating on NFTs will ebb and flow and will create spectacular rises and gut-wrenching crashes. But the [incentives for creators to use them as a monetization tool] combined with the [incentives for platforms like Instagram to use them to create stickiness] combined with [humans’ addiction to community and gambling] very well might be sufficient to turn NFTs into a new speculative asset class just like cryptocurrencies - or bigger (at least bigger than the marketcap of shitcoins).

The Bored Ape Yacht Club (BAYC)

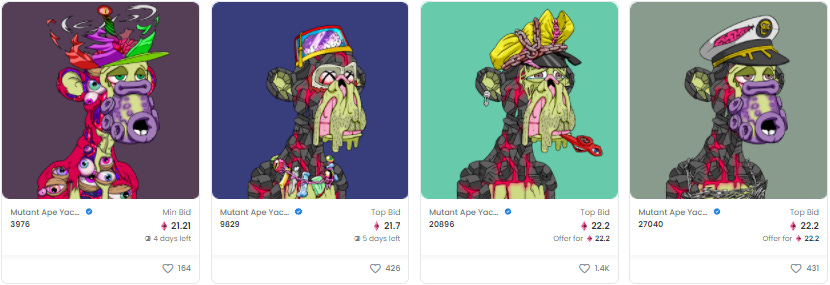

The floor price (meaning the cheapest price at which you can purchase) of the BAYC’s flagship Bored Apes is 103 Ether, or $319,300. But the BAYC collection also includes Bored Dogs, Mutant Apes, and Ape Coin.

Let’s assume that all NFTs in the BAYC collection are worth the floor price - this is the value of the ecosystem today:

BAYC Bored Apes: $319,300 x 10,000 = $3.2 Billion

Bored Dogs (8.7 Eth floor): $26,970 x 9,600 = $258,912,000

Mutant Apes (23.79 Eth floor): $73,749 x 18,500 = $1.36 Billion

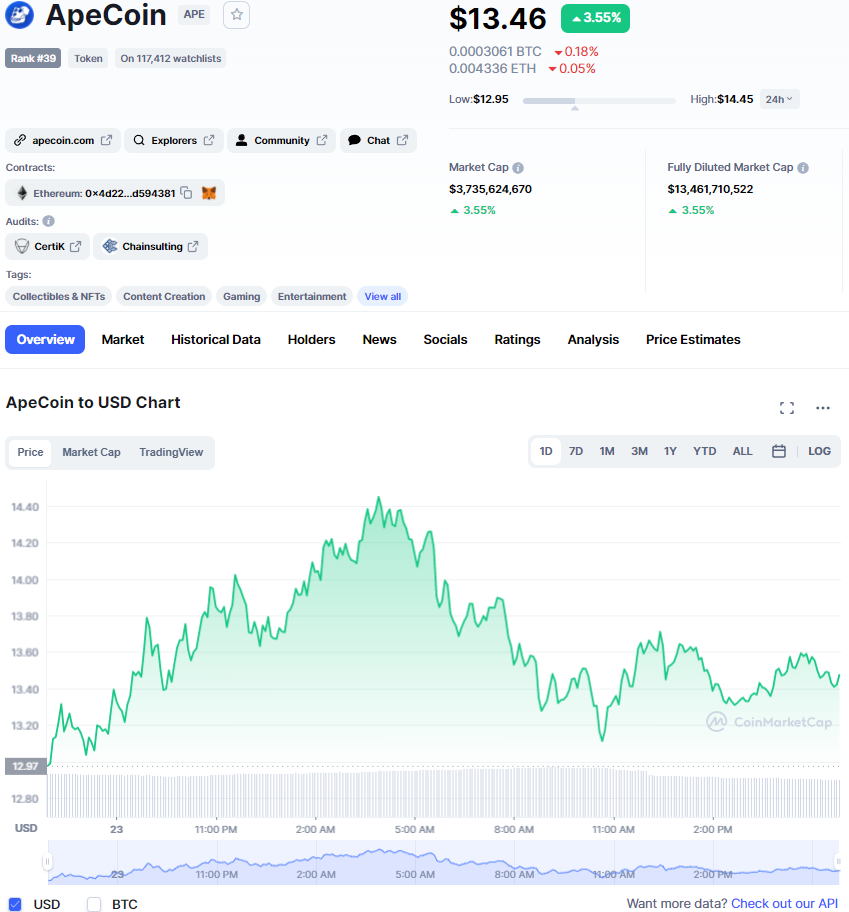

Ape Coin: $3.74 Billion (with a 24 hour trading volume of almost $2.5 billion)

Total ecosystem value: 8.56 Billion. The ecosystem value was zero on April 28th, 2021 - the day before the first Bored Apes were minted (“minting” is the equivalent of IPOs for an NFT). The real value of the ecosystem is easily more than $10 billion after you account for the NFTs that sell above the floor price.

But the story of the BAYC is far more fascinating when you consider it from the perspective of an initial buyer (at mint) who held through today (March 25th, 2022).

The cost to purchase a Bored Ape on April 29th, 2021 - the mint date - was .08 Ether. At the time of mint .08 Ether was about $2,750 - so the initial purchase price of one of the 10,000 Bored Apes was approximately $220. We’ll add $100 for the Ethereum fee (“gas”) so total cost was $320.

Then on June 18th, each holder of a Bored Ape holder received one free Bored Ape Kennel Club pass which allowed them to mint a Bored Dog. The only cost was the transaction fee paid to the Ethereum network (let’s call it $100). Total cost basis now $420.

Then on August 28th, Each Bored Ape holder was air dropped a “Mutant Serum” that allowed them to mint a Mutant Ape. Again, the only fee was gas. Total cost basis now $520.

Then, on March 17th, 2022 if you held a Bored Ape, a Bored Dog and a Mutant Ape you received 12,992 Ape Coins. Again, the only fee was gas. Total cost basis now $620.

The total value of each of the above components of the BAYC ecosystem is now equal to (at minimum):

$319,300 for the Ape +

$26,970 for the Dog +

$73,749 for the Mutant +

$174,352.64 for the Ape Coin

The total is: $594,371.64 on an initial investment of $620 - all earned over the course of 11 months.

Your takeaway might be that this is obviously unsustainable and bound to result in the most spectacular crash in all of history. You might be right.

For what its worth, Andreesen Horowitz (a16z) - one of the most successful venture capital funds of all time - just led a $450 million seed round in Yuga Labs - the creator of the BAYC - at a valuation of $4 billion. Opensea - the primary place for people to speculate on NFTs - recently raised $300 million at a $13.3 billion valuation and is doing $5 billion a month in transaction volume.

The BAYC pitches itself as an online community. Owners of Apes own the intellectual rights to use their Ape in whatever way they see fit. Los Angeles restauranteur Andy Nguyen is opening a restaurant called Bored and Hungry. Celebrity owners of Bored Apes include:

Steph Curry

Post Malone

Jimmy Fallon

Justin Bieber

LaMelo Ball

Mark Cuban

Neymar

Shaquille O’Neal

Serena Williams

Steve Aoki

Diplo

Eminem

Future

Kevin Hart

Paris Hilton

DJ Khaled

Meek Mill

Alexis Ohanian

Gwyneth Paltrow

Logan Paul

Snoop Dogg

Gary Vaynerchuk

Waka Flocka Flame

And many many more. Bored Apes have become a status symbol not dissimilar to owning a Picasso. The BAYC has become an exclusive global community. Purchasing a Bored Ape will immediately get you thousands of followers on Twitter (google #apefollowape).

Owners of Apes are now getting privileged access to clubs in Miami. Adidas launched a collection of NFTs that entitles their holders to exclusive, limited run clothing. Members of the BAYC (including Mutants) were able to get early access to the Adidas NFTs, which are now worth about $4,500 each. The manager of the BAYC is none other than Guy Oseary, who personally manages Madonna and U2, and whose company counts Paul McCartney, Shania Twain, Miley Cyrus, Britney Spears and The Weeknd.

The best way to predict the outcome of a phenomena is to analyze the incentives of the parties with influence.

People and entities with the capability to influence the future of NFTs include:

Creators

Fans

Speculators (degenerate gamblers)

Celebrities

Entrepreneurs

Venture capitalists

Wall street bankers

Hedge funds

Companies like Instagram

Government (CFPB, SEC, etc)

Only #10 above will have any interest in limiting the future potential of the NFT market - and I doubt they’ll be able to hold back the tide.

Here’s a bit more detail on potential use cases:

Digital Asset Ownership: Think Fortnite Skins that become liquid and tradeable. Someone paid $500,000 for the last football Tom Brady threw (which has now been “rug pulled” by his unretirement). Fortnite tournament championships now have prize pools in excess of $20 million - what would a young gamer with wealthy parents be willing to shell out for a custom single edition skin given to the winner?

Digital art would also fall under this category

Intellectual property rights like our example with Justine Beaver. Also, consider the possibility of using NFTs to fund a small team doing genetic research - they could crowdsource their project by fractionalizing ownership in the patents they issue.

Ownership in real property. NFTs could be programmed to represent the equivalent of limited and general partners in an apartment complex development. Or, imagine using NFT’s to IPO a skyscraper in downtown Chicago instead of paying an investment bank $100 million to sell it.

Digital identifications, similar to driver’s licenses but used instead to prove ownership of pseudonymous identities online.

Membership-clubs like our example with the Bored Ape Yacht Club

I’ll close with an example of something that might be one of the cleverest schemes in history (only time will tell if it is a total scam or ends up following through with the purpose it purports to serve).

The OpenDAO pitched itself as: A way to pay tribute, protect and promote the non-fungible token industry and those who are part of it. In addition, the project wants to show gratitude to all NFT creators, collectors and marketplaces for bringing this new industry to the forefront. Anyone who has bought, sold, or traded an NFT through the OpenSea NFT marketplace is eligible for the $SOS token airdrop. At the moment of this writing, $SOS tokens were distributed to over 241,000 addresses and counting.

However, the $SOS token is not just an airdrop for existing users…The tokens will be distributed as follows:

50% is airdropped to OpenSea users

20% will be used for staking incentives

20% are used by the OpenDao treasury

10% are used for liquidity provider incentives

Let me translate. The creators of this token invented a currency out of thin air, and retained control of 50% of the supply. Humans being humans, they decided to attribute a value of more than $500 million when the token started trading. The current daily trading volume of $SOS is more than $40 million, and was as high as $200 million when it launched in December of last year - thereby providing the creators plenty of liquidity to exit. Brilliant isn’t it? Who needs to start a company when you can just give 200,000 people a new currency and count on human nature to provide your exit liquidity.

It will become increasingly easier to create NFTs. It will become increasingly easier to trade NFTs. NFTs tug on the evolutionary desire of humans to be part of a community. NFTs will soon offer the easiest mechanism to elicit the dopamine drip from gambling the world has ever seen. NFTs are globally and anonymously tradeable - so the potential for speculation to push things wildly up or down is hard to fathom. NFTs will enhance the liquidity of digital and real assets by an order of magnitude.

Yes the existing market might implode 90% in a matter of weeks - but the technology is here to stay - the use cases are too strong and the incentives of the relevant participants all align to push proliferation, not extinction.

Pandora’s Box has been opened…