“When I’m feeling down and troubled - when nothing seems capable of cheering me up - I write down everything I’m grateful for. Invariably, the economic shrewdness of Bernie Sanders and Elizabeth Warren tops my list. As long as these two economic oracles are around I know the economy will be just fine.”

-said no one ever

To be fair: price gouging is real. Everyone remembers watching the price of hand sanitizer skyrocket in 2020. Or, you may remember hearing a story about the price of water bottles and gasoline reaching extreme levels during a disaster (there are many). The linked article describes the price gouging laws of five states in particular: Florida, Texas, New Jersey, Hawaii, and Louisiana. 35 states had them in place at the time the article was written. Price gouging can absolutely be the result of pure unadulterated corporate greed, but it is only possible when a market has become acutely ill. And, when price gouging is taking place there often has been an increase in cost of goods sold (COGS) to the seller, even if it is an order of magnitude smaller than what they are trying to gouge through.

Answering “yes” to the following question is a necessary (but not sufficient) condition for identifying price gouging: is there an obvious single cause? If there is then you may be looking at price gouging. However, I want to stress that it is often not obvious who the gouger is. If a country is in the midst of a civil war and the price of gasoline is 10X what is usually is, that may be because the local small business gas station paid 10X what they normally do.

If the answer is “no” then you certainly have not identified a case of price gouging.

$20 per gallon for gas the day after a Hurricane? Price gouging with a possible (likely even?) transient increase to seller’s cost. While the business may be expecting an increase it would not be sufficient to justify $20 per gallon, even temporarily.

$300 per night for a dirty motel room the day after a flood? Unadulterated price gouging because there has been no increase in the cost of providing the room.

$12 for an 8oz bottle of sanitizer in July of 2020 (months after Covid started)? Price gouging with an underlying increase in cost.

The price of gasoline doubling nationwide? Not price gouging.

The price of chicken and turkey rising nationwide? Not price gouging.

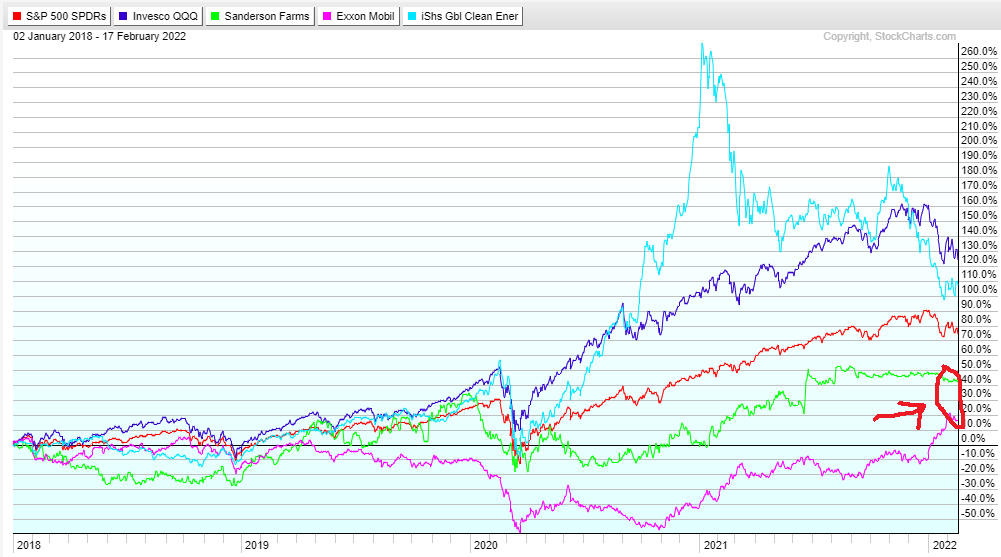

The below image shows the stock prices since the beginning of 2018 of the two companies Bernie and Liz call out, Exxon Mobile and Sanderson Farms – vs. the performance of the S&P 500 index, the Nasdaq 100 index, and a clean energy fund. It is clearly lost on them that among all companies – commodity producers have the least pricing power.

If it isn’t price gouging then it is inflation. Inflation is a different beast entirely. A complex beast.

In this post I will use a real world case study to illustrate the impact inflation is having on businesses across the country. Specifically, we’ll be looking at inflation (since the beginning of Covid) through the lens of a small, family-owned chemical manufacturer based in the southeast United States.

This anecdote speaks more accurately to the transitory vs. lasting debate than anything I’ve seen elsewhere - but that’s not what inspired me to write this post. What inspired me was how obviously false is the narrative that inflation is caused by corporate greed. That is the only takeaway I’m stating explicitly. I’ll let you come up with your own takeaways regarding the broader (legitimate) debate around transitory vs. lasting.

Before diving into the case study I want to first explain why I call inflation a complex beast.

I saw this meme on Twitter (someone posted it in response to Liz’s tweet) and it made me laugh so I am posting it here. While the logic may be appealing, it is unreliable.

“The whole is more than the sum of its parts.” - Aristotle

Aristotle is the first person (on record) to explain the concept of emergent properties. A whole being more than the sum of its parts is the idea underlying Chaos Theory and Complexity Science. Inflation is part of the complex system - price setting - within the larger complex system of human economies. Stock markets (like inflation) would be another example of a complex system that is part of the larger complex system of price setting. The global economy is like a Russian Nesting doll of complex systems.

I found this pithy explanation of Complexity Science and highly recommend scrolling through it. I’ve pulled out their definition below:

Complexity science, also called complex systems science, studies how a large collection of components – locally interacting with each other at small scales – can spontaneously self-organize to exhibit non-trivial global structures and behaviors at larger scales, often without external intervention, central authorities or leaders. The properties of the collection may not be understood or predicted from the full knowledge of its constituents alone. Such a collection is called a complex system and it requires new mathematical frameworks and scientific methodologies for its investigation.

Other examples of complex systems include biology, the human brain, insect colonies and the climate.

George Soros wrote a book about what he calls Reflexivity. From Investopedia: Reflexivity theory states that investors don’t base their decisions on reality, but rather on their perceptions of reality instead. The actions that result from these perceptions have an impact on reality, or fundamentals, which then affects investors’ perceptions and those prices. The process is self-reinforcing and tends toward disequilibrium. Soros views the global financial crises as an illustration of the theory. In his view, rising home prices induced banks to increase their home mortgage lending and, in turn, increased lending helped drive up home prices. Without a check on rising prices, this resulted in a price bubble, which eventually collapsed.

George Soros might argue that inflation is predictable to a sufficiently savvy game theorizer well versed in reflexive thinking. If he did I would have to (timidly) disagree.

I believe reflexivity is real and that it can lead to disequilibrium. What I am less inclined to believe is that reflexivity is useful as a predictive tool (the returns of global macro hedge funds have been abysmal, which I take as evidence for my perspective). Using inflation as an example, as powerful as the reflexive forces of [human intuition and expectations / government addiction to spending / money printing / other?] may be, there are other forces at play (like technology driven deflation) which may yet win the day. According to this post by Joe McKendrick on ZDNet, an iPhone would have cost $3.6 million in 1994. There are always other forces at play.

The only opinion I hold on inflation is that it is (in the long-run) inherently unpredictable. I’ll admit that I am drawn to the idea that money printing is inflationary. But I am also cognizant of how frequently this view has been wrong in the past. Here’s Kyle Bass - someone who became famous for predicting the housing crash - explaining why Japan (the world’s most expert money printer) is about to implode. Shorting Japanese government bonds because you expect low interest rates and high debt to be unsustainable has now become the most famous widow maker trade. It hasn’t worked for a few decades and counting. Here’s a Wall Street Journal article explaining why “Stimulus” (in the US) will mean inflation - written in 2009. Maybe Kyle will end up being right, but if you aren’t correct over a time frame of ten years does it really matter?

The one thing we can know for certain about inflation is that the root cause is not corporate greed. Corporate greed can cause price gouging, but not inflation.

Now for the anecdote.

Quick background on the business before we get started.

It’s a small chemical manufacturer that mostly makes chemicals for the auto detailing industry (spray waxes, polishing compounds, leather cleaners, etc). It was founded in 1989 and has 26 employees. It is a family-owned business. Below are some stats about the usage of certain raw materials over the course of an average year:

1. ~750,000 pounds of chemical raw material

2. ~750,000 plastic bags (coincidentally the same)

3. ~800,000 bottles

4. ~800,000 caps (not a coincidence)

5. ~500,000 sponges/towels

6. ~600,000+ labels/barcodes

7. ~40,000 square feet of space

8. ~$200,000+ annual spend on shipping and shipping supplies

Our story starts in January of 2020.

The business is growing and life is good. Isopropyl alcohol (henceforth: IPA) – a key ingredient in products ranging from glass cleaner to polishing compounds – is $0.82 per pound. The business gets an order from a customer which requires IPA, so it calls its normal supplier and orders 12 drums. Each drum is 355 lbs, so each drum costs: $291.10

The IPA arrives within a few days because it is kept in stock.

The business needs some bottles and tops to fulfill the order. They are ordered and arrive within a week because they are also kept in stock.

Neither the IPA nor the bottles or tops have increased in price over the past year. So, there has been no need to increase the price to the businesses’ customer.

Life is good.

March 16th, 2020

President Trump tells the country it needs to shut itself in for 15 days to slow the spread of Covid-19 so that hospitals do not become overwhelmed.

March 17th, 2020

Amazon announces it will stop accepting nonessential items to warehouses.

Overnight the small business’s sales drop by 30%. Many of their products are sold on Amazon but none of them qualify as “essential”. It gets worse. The next time the business goes to place an order for bottles – they’re out of stock. They call 3 more suppliers and it’s the same in every case. Eventually they find some bottles that are the right size, but they’re a different color. Same thing happens with tops. All plastic nationwide has been re-directed to manufacturers of cleaning products.

The business – like many in the chemical and brewing industries at the time – started making hand sanitizer. Because bottles and tops were impossible to find in the United States (or prohibitively expensive), the small business for the first time ever ordered them from China. The cost to ship a 40’ container was around $3,500. The cost of IPA – the key ingredient in hand sanitizer – was $1.44 per pound, nearly a 100% increase.

The hand sanitizer sold as fast as they could make it, but the cost of IPA kept changing. By May 15th the price per pound had increased to $2.53/lb. But unlike before, by May it was impossible to find IPA from their usual suppliers, so it had to be shipped in from wherever in the country they could locate it. Extra shipping costs brought the total per pound to $2.72. That’s a 3.32X increase from what they had paid in January.

The price of IPA topped out at $3.83 per pound, but it didn’t stay there long. By August the price had plummeted to $1.21.

Today, the price of IPA fluctuates around $1.30. Still an increase of 59% above where it started, but far below the peak. Plastic Bottles and tops have increased in price (more below) but they can once again be ordered from US based suppliers. Lead times for some bottles and tops are still measured in months rather than weeks, but they are steadily coming down. Products that used to be held in stock are actually in stock about half the time.

Shortages still abound, and they remain unpredictable. Chemicals that have seen only moderate price increases and which have remained in-stock and easy to access since the beginning of Covid-19 will (seemingly) randomly be placed on months-long backorders.

But since the beginning of 2021, inflation has been spreading as fast as the Delta variant of Covid-19.

The starkest example of chemical inflation is silicones. Silicones are used in a variety of applications such as sealants, adhesives, coatings, plastics, cosmetics, medical devices, hygiene products, food contact materials and many other industrial applications.

You have probably already guessed that silicones compete with semiconductors for silicon (the raw material). You can skip the italicized details from the linked article below to jump straight to the inflation data.

Silicon has many industrial uses. As silica, silicon is a key ingredient in bricks, concrete and glass. In its silicate form, the element is used to make enamels, pottery and ceramics.

Elemental silicon is a major player in modern electronics because it's an ideal semiconductor of electricity. When heated into a molten state, silicon can be formed into semi-conductive wafers, to serve as the base for integrated circuits (microchips).

In fact, Silicon Valley, the southern region of the San Francisco Bay Area, earned its name due to the high concentration of computer and electronics companies in the area producing silicon-based semiconductors and chips.

Silicone, by contrast, is a synthetic polymer made up of silicon, oxygen and other elements, most typically carbon and hydrogen. Silicone is generally a liquid or a flexible, rubberlike plastic, and has a number of useful properties, such as low toxicity and high heat resistance. It also provides good electrical insulation.

In the medical field, silicone can be found in implants, catheters, contact lenses, bandages and a variety of other things. You can also find silicone in a number of personal care items, including shampoos, shaving cream, personal lubricants and sex toys.

Due to its high heat resistance, silicone makes up a lot of kitchenware, such as oven mitts, tongs and pan handles; silicone's non-stick properties also make it useful for cookware coatings. Additionally, the material's heat resistance and slipperiness make it an ideal lubricant for automotive parts (as a lubricating spray or grease).

In other industries, silicone is commonly used as a sealant for watertight containers (e.g., aquariums) and plumbing pipes.

And, like silicon, silicone is important in electronics — it's used to make casings that can shield sensitive devices from electrical shocks and other hazards.

The two silicone fluids this business purchases most frequently – let’s call them silicone 1 and silicone 2 – started 2020 at $1.16 per pound and $1.24 per pound respectively. Prices actually went down on silicone 1 to $1.01 per pound by the third quarter. Silicone 2 prices stayed flat. Then, starting in Q1 of 2021, all hell broke loose.

January 2021 Pricing:

1. Silicone 1: $1.63

2. Silicone 2: $1.43

March 2021 Pricing:

1. Silicone 1: 1.72

2. Silicone 2: $1.57

Starting in May, supply disappeared completely for silicone 1 unless you were capable of paying multiples of what the price had been only months earlier.

July 2021 Pricing:

1. Silicone 1: $3.31

2. Silicone 2: $2.04

August 2021 Pricing:

1. Silicone 1: $4.69

2. Silicone 2: $2.04

September 2021 Pricing:

1. Silicone 1: $5.75

2. Silicone 2: $2.38

December 2021 Pricing:

1. Silicone 1: $9.98

2. Silicone 2: $3.12

Summary:

1. Silicone 1 Start Price = $1.16 || Silicone 1 Finish Price = $9.98

2. Silicone 2 Start Price = $1.24 || Silicone 2 Finish Price = $3.12

As I’m writing this on February 25th, 2022 the cost of these products for delivery in late March has started to come down. Silicone 1 is now less than half of the above price if you can wait until then to take delivery.

What about other costs? Let’s look at some anecdotes from each line item above.

#1 Chemical raw materials:

Sodium Hydroxide: $.205/lb to $0.38 - increase of 85% (peak cost: $.58/lb)

Glycol Ether: $.72/lb to $1.92/lb - increase of 2.67X (peak cost: $2.14)

Mineral Oil: $7.15/gallon to $10.9/gallon - increase of 52% (still at peak cost)

Chemical cost increases range from 5% at the low end to the near 10X increase in certain silicones I mentioned above. But that’s not all. Chemicals, like Bottles and Tops below, would in some cases be even more expensive if they were not purchased in far larger quantities than had been necessary before.

#2 Plastic Bags: Range from no increase to an increase of 20%

#3 Bottles and #4 Caps: Bottles and caps have seen increases ranging from 5-20%. However, the increases would be larger if the business were not buying in higher volumes. To combat price increases on bottles and tops the business is now buying 3-6 months of supply at a time rather than being able to purchase only what they need for a specific order. This (along with the chemicals mentioned above) has necessitated leasing an additional 10,000 square feet of warehouse space.

#5 Sponges/Towels: ~7.5%

#6 Labels/Barcodes: ~5%

#7 Warehouse space increases every year due to the structure of the lease, but the primary increase in cost is due to needing the additional square footage.

#8 Shipping and Supplies: The starkest example of the increase in shipping costs is the cost of shipping a 40’ container from China - which has increased from $3,500 to over $20,000. Freight costs generally are up between 10 and 15%. Stretch wrap for securing pallets is up 32%. Cardboard boxes are up 12%.

Chemical prices have started to come down. Everything else is at peak prices.

I’ll leave you with one more anecdote. I bought a used Subaru legacy for $10,000 two years ago. A car dealership near me just offered $18,000.

So do I think inflation will be transitory or lasting?

Yes.