Remember: Meta = the whole business; Facebook = the Facebook App specifically

Before diving into Instagram I want to address the elephant in the room: TikTok. In part 1 of this series I called TikTok nothing but a highly addictive online/mobile destination for passing time. I was being dismissive to set up the point that Facebook has a broad variety of use cases which collectively make it far stickier and far likelier to be around in the distant future than a social media app that is largely built around a single mechanic. But that wasn’t fair of me. Though not an existential threat, TikTok is the most impressive adversary Meta has ever faced. I say this for two reasons:

TikTok’s parent company ByteDance has already proven itself adept at expanding into other social mechanics and building use cases outside of entertainment with its Chinese version of TikTok - called Douyin. Douyin is a far more feature rich app than TikTok. If you want to understand where TikTok is headed, looking at where Douyin has already been is a good place to start. Ecommerce is an impressive example. From Reuters: “Douyin is targeting a jump in GMV to over 1 trillion yuan ($155 billion) this year…That’s more than 6 times the 150 billion yuan it was on track to earn last year”.

ByteDance is massive and is one of the fastest growing companies in history. Its revenue last year was estimated at $58 billion, up 70% from 2020 ($34 billion), and up 3.5X since 2019 (~$17 billion). Compare that to Snap ($4.1 billion) and Twitter ($5.1 billion). According to the South China Morning Post last October, ByteDance’s valuation has fluctuated between $325 billion and $450 billion in recent months (though the company’s internal buy-back scheme values it as $US200 billion). Snap is worth $67 billion. Twitter is worth $30 billion.

There are other companies who should be worried about TikTok. Snap, Google (b/c of Youtube) and Netflix among them. If ByteDance starts trying (it will) to turn TikTok into a full fledged international version of Douyin, then I could see some interesting unholy alliances forming to get it banned in the Western World (India will probably beat them to the punch). But that is a topic for another post.

I may talk about TikTok more in a future post, but for now on to Instagram.

An article by Salvador Rodriguez in CNBC sets us up nicely:

Ever since Twitter launched in 2006, Facebook had viewed it as its main competitor…by the end of 2011, Facebook boasted 845 million monthly average users while Twitter claimed over 100 million…

The competitive landscape grew more heated in June 2011 when Google made a full-court push into Facebook’s domain with Google+…By the end of the year, Google claimed 90 million monthly active users for the service…

In 2011, Facebook’s mobile apps ran slow and felt bloated...to optimize the app and grow on mobile the company decided to spin out different features. The most well-known of these spinoffs was Messenger.

On Friday, April 6, 2012, Twitter made a $500 million offer for Instagram…Facebook had been developing its own Camera app in hopes of winning the mobile photo market on its own, but with Twitter making a play for Instagram, Zuckerberg was forced to act fast…Zuckerberg had Amin Zoufonoun, Facebook’s head of corporate development, come to his house and the two put together every document they would need to finalize the deal over the course of one weekend.

Meta then shocked the world by paying $1 billion for a company with only 13 employees and negligible revenue. Twice Twitter’s offer, and twice the valuation at which mere days before Instagram had raised money. Meta was widely panned for spending so much money on an app that only had 35 million users and no moat. Besides, as everyone knew at the time, Facebook had such a bad reputation (yes, that’s been a thing since the IPO) that surely all of Instagram’s users were going to leave, thereby making the acquisition completely pointless in the first place.

At the time Instagram was a photo sharing app that was widely considered a tool for amateur photographers. Naturally, everyone had an opinion:

“But you’re not an artist. If you were an artist, you wouldn’t be using Instagram in the first place. You certainly wouldn’t be using a filter as a crutch. At the end of the day, that’s what Instagram filters are: a crutch, a misguided replacement for a properly composed shot and a decent sensor.” – Chris Ziegler (The Verge)

“At this rate Facebook’s going to end up owning the rights to all actual human faces.” – Charlie Booker (Guardian)

“If I had $1 billion to spend, I think I’d actually prefer patents to a social network.” – Gabriel Snyder (The Atlantic Wire)

Most people thought Zuck was crazy. Here’s a twitter thread by @AlecStapp that starts off with a hilarious clip from John Stewart’s Tonight Show making fun of how insane the price was.

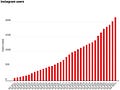

But Instagram grew. And grew. And grew!

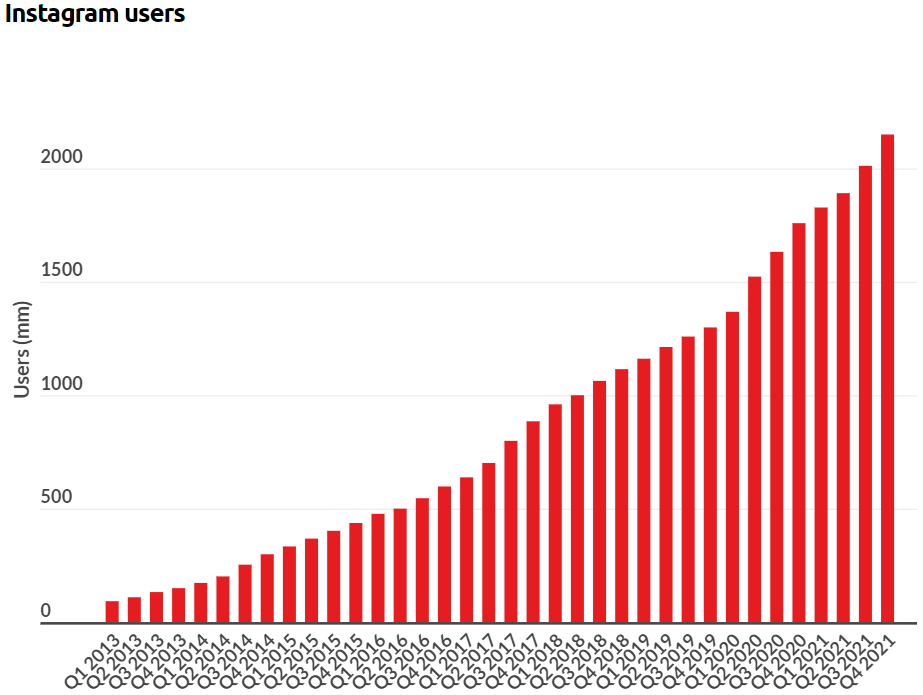

Across all social media, only TikTok’s growth has been more impressive. Note that the chart below starts in 2018 (at 80 million).

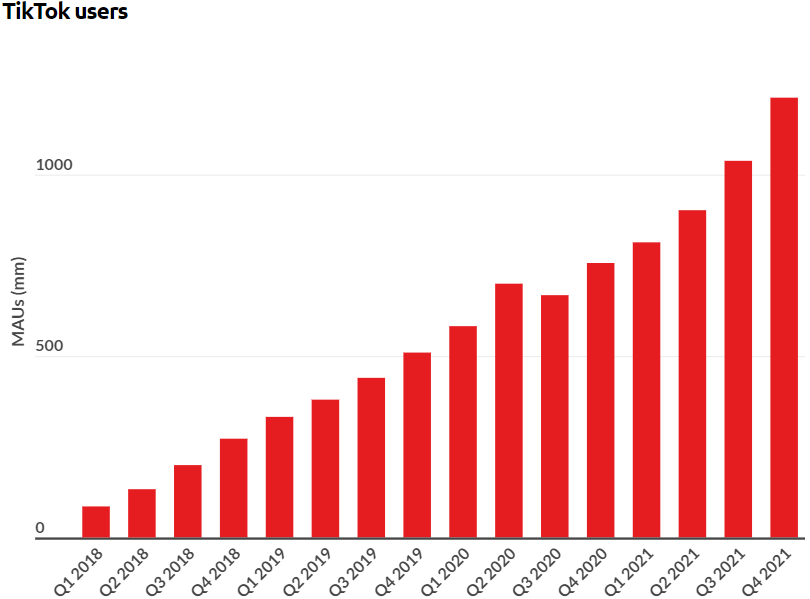

Here’s a summary of user growth for TikTok, Instagram, Snapchat, Twitter and Facebook. Unfortunately I couldn’t find reliable DAU info for Instagram and Tiktok over the period. Orange = Monthly Active Users. Yellow = Daily Active Users.

Figures in millions

The data isn’t perfect because we’re comparing MAU growth to DAU growth, but if the rate of growth is the same between MAU and DAU then we can conclude that Instagram is growing faster than both Snap and Twitter, even though it started from a massively larger base.

TikTok’s rise has created a very exciting predicament for Meta (I enjoy few things more than watching tech titans battle). Does Meta (mostly via Instagram) go back to their roots of competing for in-app time above all else?

Remember that Meta, as many people seem to have forgotten, decided to change the metrics it was optimizing for. Enter: Meaningful Social Interactions.

Adam Moserri (then head of News Feed, now leading Instagram) had this to say:

Facebook was built to bring people closer together and build relationships. One of the ways we do this is by connecting people to meaningful posts from their friends and family in News Feed. Over the next few months, we’ll be making updates to ranking so people have more opportunities to interact with the people they care about.

With this update, we will also prioritize posts that spark conversations and meaningful interactions between people. To do this, we will predict which posts you might want to interact with your friends about, and show these posts higher in feed. These are posts that inspire back-and-forth discussion in the comments and posts that you might want to share and react to—whether that’s a post from a friend seeking advice, a friend asking for recommendations for a trip, or a news article or video prompting lots of discussion.

As we make these updates, Pages may see their reach, video watch time and referral traffic decrease. The impact will vary from Page to Page, driven by factors including the type of content they produce and how people interact with it. Pages making posts that people generally don’t react to or comment on could see the biggest decreases in distribution. Pages whose posts prompt conversations between friends will see less of an effect.

The idea was to de-prioritize click-bait, viral conspiracy theories and other forms of “degenerate” content. Doing so sacrificed engagement and undoubtedly reduced total time spent in app.

Has TikTok already catalyzed a return to the brutal fight for attention? It looks like the answer is yes. Adam Moserri put out a great little explainer video of how Instagram’s algorithm works last June.

My summary and takeaways below:

Ranking Feed and Stories. With Feed and Stories this (ranking algorithm) is relatively simple; it’s all the recent posts shared by the people you follow. There are exceptions like ads, but the vast majority of what you see is shared by those you follow.

In order of importance:

1. Information about the post. These are signals both about how popular a post is – think how many people have liked it – and more mundane information about the content itself, like when it was posted, how long it is if it’s a video, and what location, if any, was attached to it.

2. Information about the person who posted. This helps us get a sense for how interesting the person might be to you, and includes signals like how many times people have interacted with that person in the past few weeks.

3. Your activity. This helps us understand what you might be interested in and includes signals such as how many posts you’ve liked.

4. Your history of interacting with someone. This gives us a sense of how interested you are generally in seeing posts from a particular person. An example is whether or not you comment on each other’s posts.

Ranking Explore. Explore was designed to help you discover new things. The grid is made up of recommendations – photos and videos that we go out and find for you – which is very different from Feed and Stories, where the vast majority of what you see is from the accounts you follow.

In order of importance:

1. Information about the post. Here we are looking at how popular a post seems to be. These are signals like how many and how quickly other people are liking, commenting, sharing, and saving a post. These signals matter much more in Explore than they do in Feed or in Stories.

2. Your history of interacting with the person who posted. Most likely the post was shared by someone you’ve never heard of, but if you have interacted with them that gives us a sense of how interested you might be in what they shared.

3. Your activity. These are signals like what posts you’ve liked, saved or commented on and how you’ve interacted with posts in Explore in the past.

4. Information about the person who posted. These are signals like how many times people have interacted with that person in the past few weeks, to help find compelling content from a wide array of people.

Ranking Reels. Reels is designed to entertain you. Much like Explore, the majority of what you see is from accounts you don’t follow. So we go through a very similar process where we first source reels we think you might like, and then order them based on how interesting we think they are to you.

With Reels, though, we’re specifically focused on what might entertain you. We survey people and ask whether they find a particular reel entertaining or funny, and learn from the feedback to get better at working out what will entertain people, with an eye towards smaller creators. The most important predictions we make are how likely you are to watch a reel all the way through, like it, say it was entertaining or funny, and go to the audio page (a proxy for whether or not you might be inspired to make your own reel.)

They literally say, TWICE, that Reels is designed to entertain you. They’ve even started using TikTok’s audio indicator!

In order of importance:

1. Your activity. We look at things like which reels you’ve liked, commented on, and engaged with recently. These signals help us to understand what content might be relevant to you.

2. Your history of interacting with the person who posted. Like in Explore, it’s likely the video was made by someone you’ve never heard of, but if you have interacted with them that gives us a sense of how interested you might be in what they shared.

3. Information about the reel. These are signals about the content within the video such as the audio track, video understanding based on pixels and whole frames, as well as popularity.

4. Information about the person who posted. We consider popularity to help find compelling content from a wide array of people and give everyone a chance to find their audience.

Note two things about Reels vs. the other sub-apps. First, Activity has jumped from 3rd place to 1st. Second, note the change in language regarding the role of the “Person who Posted”.

In Feed and Stores, the Person Who Posted… This helps us get a sense of how interesting the person might be to you, and includes signals like how many times people have interacted with that person in the past few weeks.

In Explore, the Person Who Posted… These are signals like how many times people have interacted with that person in the past few weeks, to help find compelling content from a wide array of people

In Reels, The Person Who Posted… We consider popularity to help find compelling content from a wide array of people and give everyone a chance to find their audience.

Reels is clearly a different beast whose target is TikTok. It was launched in August of 2020, and Meta now says it is the largest driver of engagement for Instagram. Meta launched Reels on Facebook in September of last year. Like Al Pacino, Meta appears to have been pulled back in!

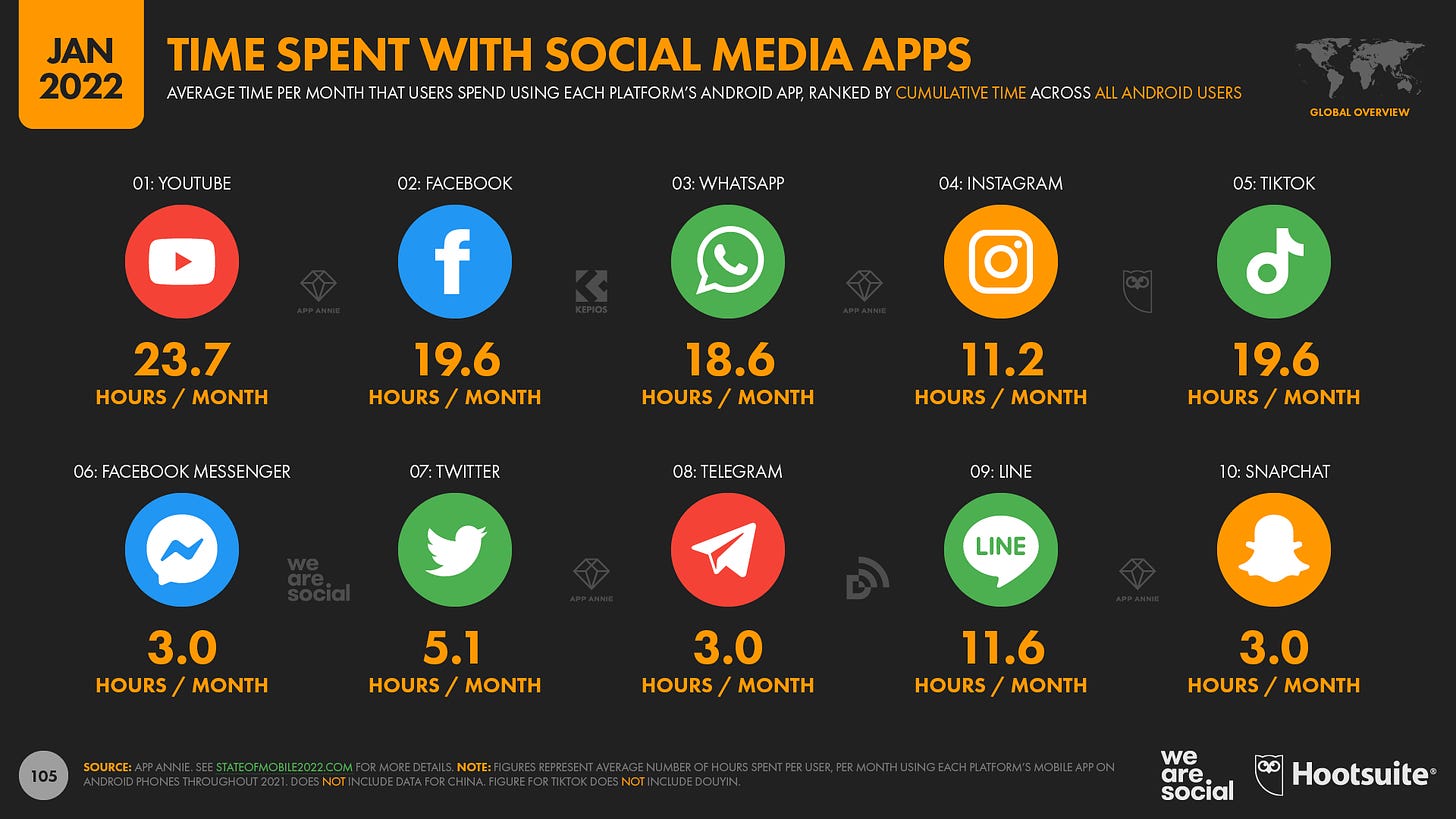

So far, Instagram is losing the battle for time-share to TikTok. The chart below will be one to keep an eye on.

Two notes about the chart: 1) It is Android only; 2) It is showing average hours per user per month – which makes usage look smaller than it would be if we were looking only at daily active users. For example, Snap’s daily users spend 15+ hours per month, but there is a large gap between Snap’s daily active and monthly active user counts.

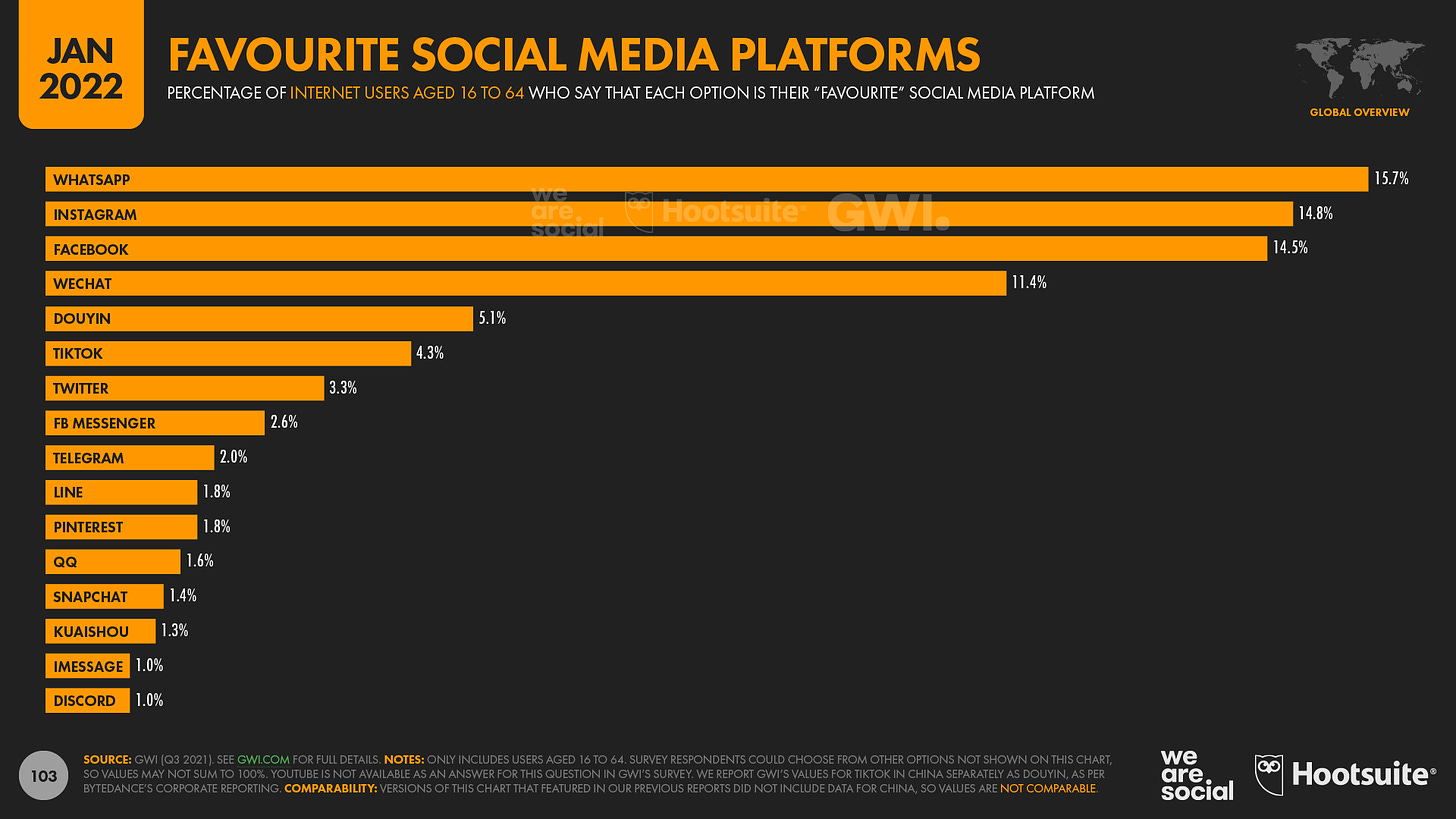

I also found this chart interesting. It shows that while TikTok is the fastest growing app in the world, few people consider it their favorite (to be fair, the percent calling it their favorite is up 71% in the past 90 days from 2.5% to 4.3%).

Note that the top 3 favorites are all Meta apps.

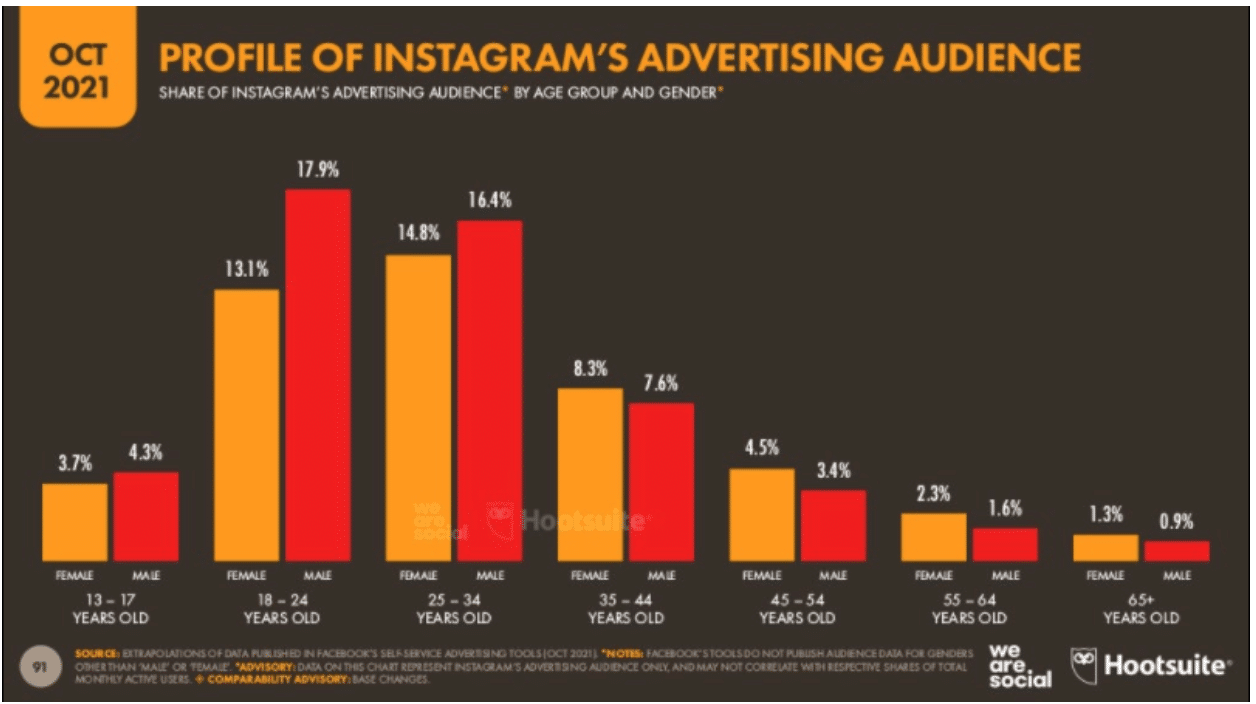

One last chart (reprinted from my first post) before closing with a thought on monetization:

I often hear the criticism that Instagram doesn’t monetize as well as Facebook. Video doesn’t monetize as well as photo. Reels won’t monetize as well as Feed or Stories. These arguments miss the forest for the trees (if you have a long time horizon). The world changes. It always has. This is bad for slow companies with less scale (legacy Television, Twitter) and good for massive companies who can adapt quickly (Meta/TikTok). Let’s use a Netflix analogy to better understand one of Meta’s core strengths.

Netflix’ primary competitive advantage is that it can spread its massive content budget across more eyeballs than its competitors. If you have 10 million customers and you spend $10 million making a show, you need to earn $1 per viewer to get your money back. If you have 100 million customers viewing your content…

Meta has 3.59 billion monthly active people. The only difference is that instead of spending on content, Meta is spending on AI and Machine learning. I’d argue that the value of AI/ML investments will prove longer lasting and more defendable than content, but that’s a topic for another post.

There is another advantage Meta has. With the exception of mobile operating systems (which see everything), Meta has visibility into more types of interactions than any company on the planet. Consider the variety of interactions that are possible on one of Meta’s platforms vs. TikTok or anyone else.

Meta includes: The World’s Most Detailed Social Web, Facebook Groups, Facebook Marketplace, Facebook Shops, Facebook Gaming, Facebook NewsFeed (now just “Feed”), Instagram Feed, Instagram Explore, Instagram Reels, Facebook Messenger, Facebook Reels, WhatsApp, WhatsApp Business, WhatsApp Payments. I’m not even bothering to mention the metaverse or their reality labs division.

More types of interactions (use cases)… mean more data… mean more effective advertising… and more ability to expand into yet more use cases or monetization strategies. TikTok is competing for eyeballs and timeshare – absolutely. It is the biggest threat Meta faces – absolutely. But it is not a mortal threat.

Whatever the future holds for advertising across any medium, Meta is better positioned than anyone (but Google) to face it.

So how successfully will Meta be able to monetize Instagram? I don’t know. What I do know is they have a proven track record of increasing ARPU. I do know that if they decide ARPU is the metric they want to optimize for, they’ll do a better job than anyone else for a given format (social mechanic). Let’s take a look at Meta’s average revenue per user over time.

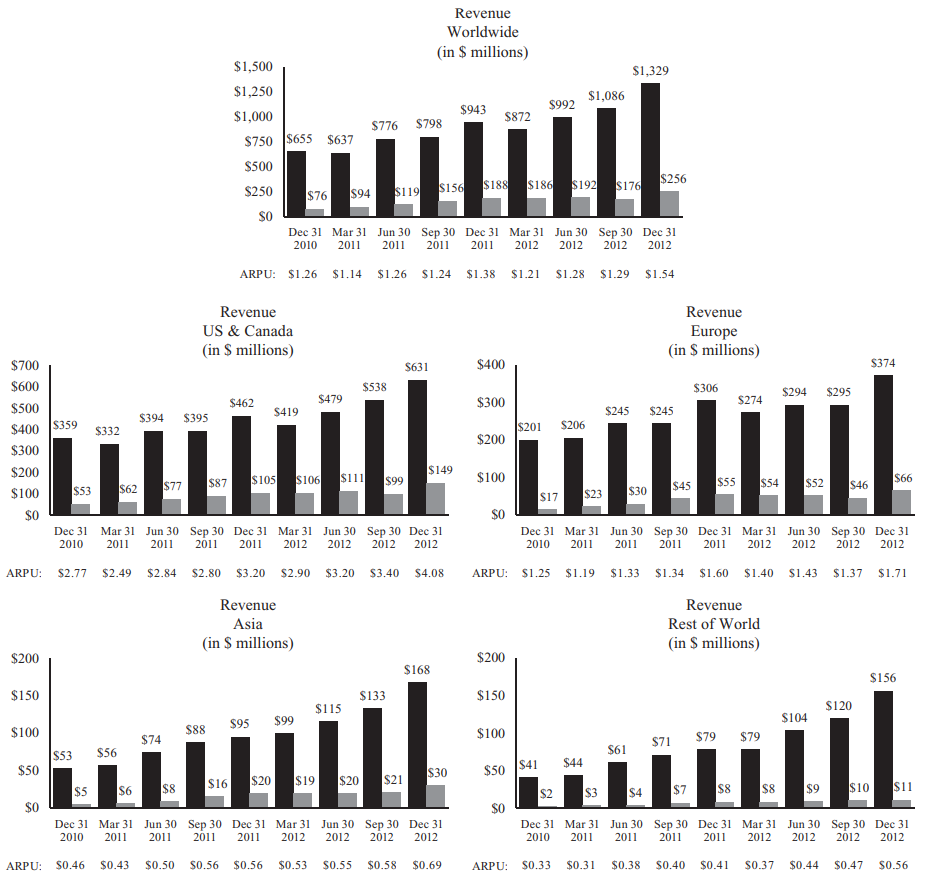

In 2012 Meta’s average revenue per user hit $1.54.

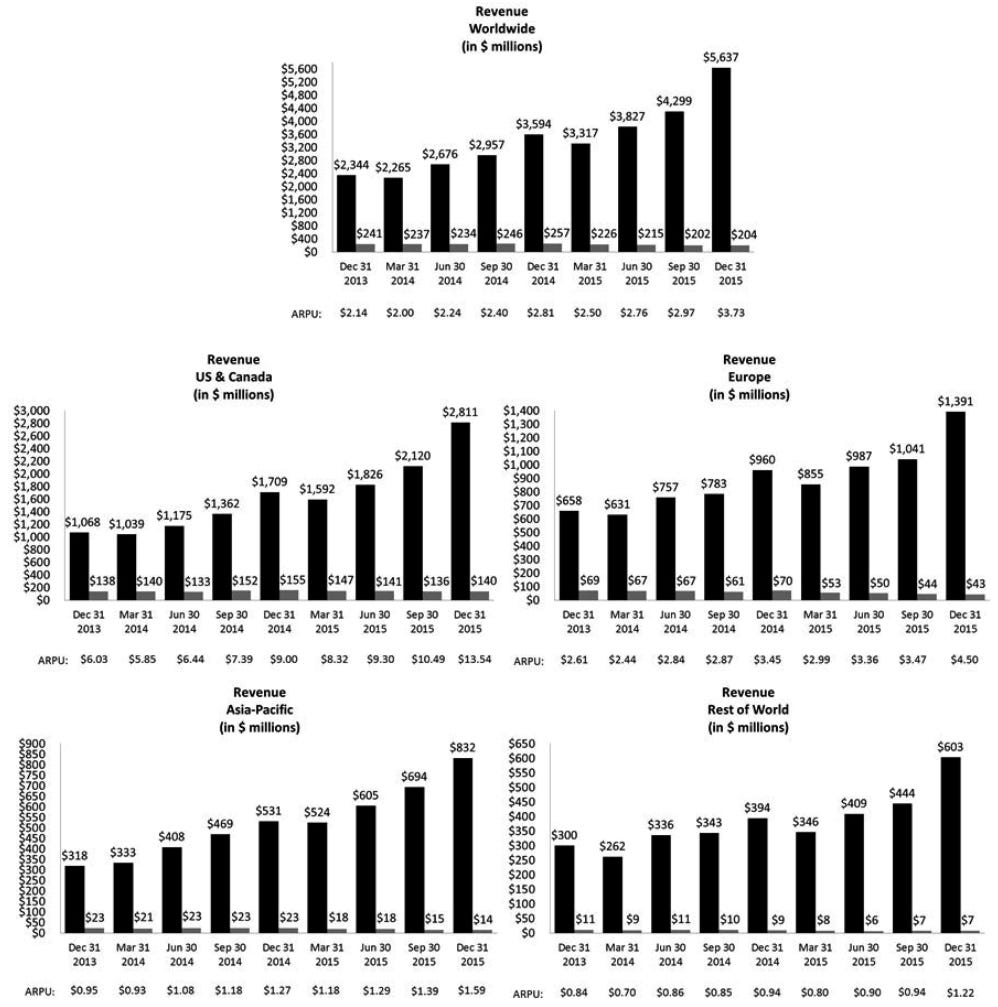

In 2015 Meta’s average revenue per user hit $3.73

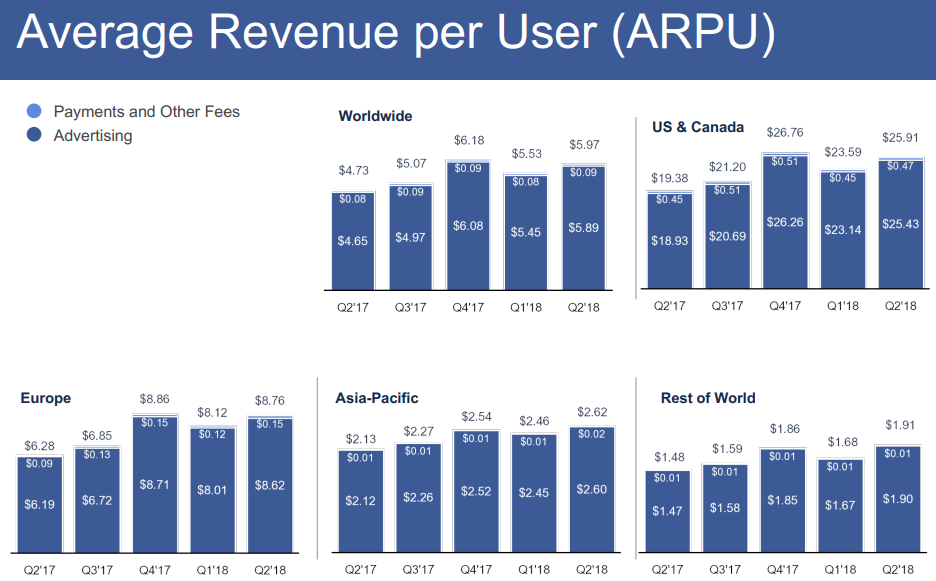

In 2018 Meta’s ARPU hit: $5.97

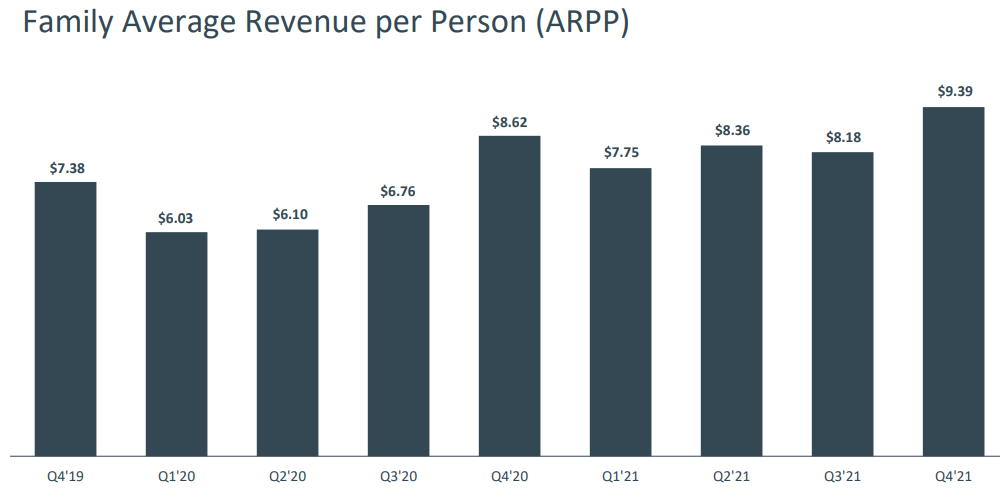

ARPU is still increasing today…

I want to stress that it’s entirely possible ARPU goes down from here. What I have confidence in is what I said above - that for a given social mechanic, Meta will monetize as effectively as anyone.

Great work. Thank you. It seems to me (I could be wrong), from looking at the disclosed numbers, all the ARPU growth since 2018 has come from Volume of Adverts. (Assuming ARPU = Volume x Price / Users). Volume of adverts always grows where as there are times when price declines significantly (Most of 2020). Is this your understanding too? What drives the volume? I assume its a platform's ability to take more Ads without damaging user experience. You can add more Volume of Ads if you are growing more users but once users stop growing there is a limit to volume of Ads unless you have new products on the platform like Reels etc? Thanks for all your help understanding Meta. Apologies if these questions are things you have answered and I have missed it.